The Pensions Regulator’s Corporate Plan 2022 to 2024 sets out our direction for the next two years.

Published: 13 June 2022

Chair and CEO joint foreword

Our Corporate Plan

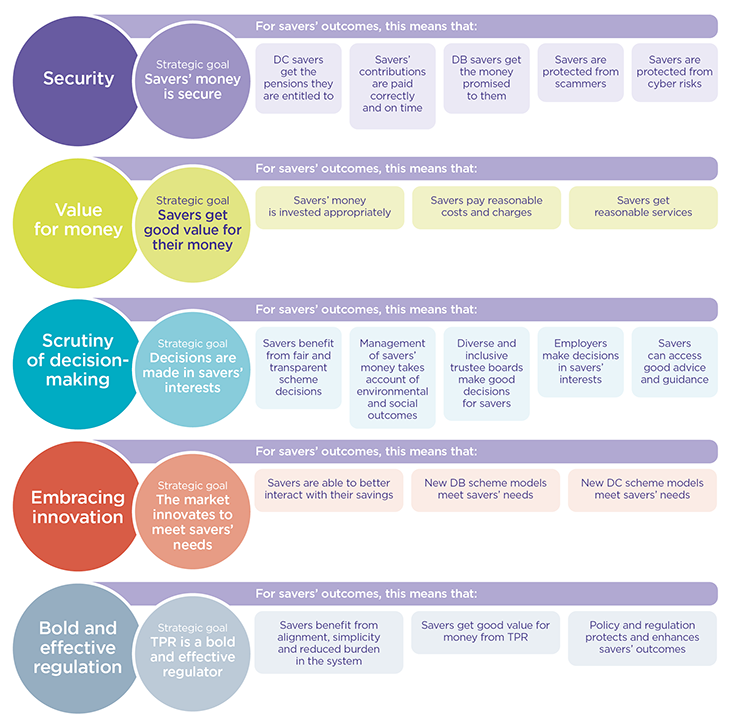

Welcome to our Corporate Plan 2022 to 2024, which updates our 2021 to 2024 plan published last year. Here, we set out our priorities for the coming year and look ahead to the final year of the period. Our Corporate Plan complements our Corporate Strategy in putting the saver at the heart of our work, enhancing and protecting all savers’ pensions through the delivery of five strategic priorities.

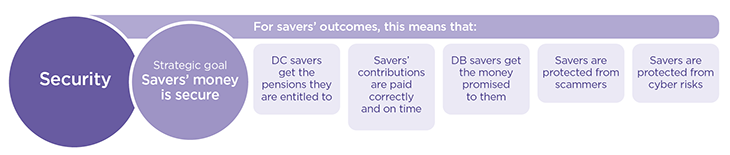

- Security – pension savers’ money is secure.

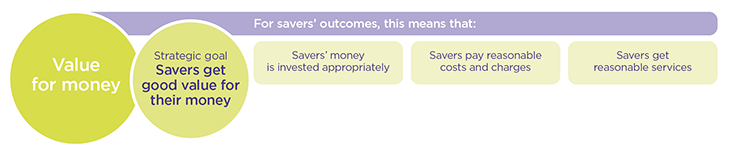

- Value for money – pension savers get good value for money.

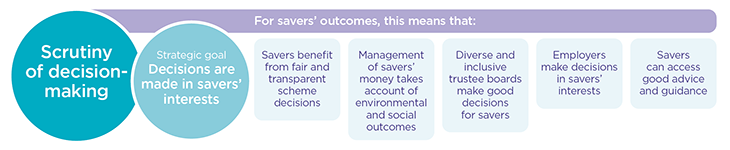

- Scrutiny of decision-making – decisions made on behalf of pension savers are in their best interests.

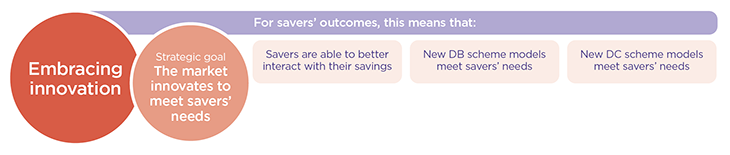

- Embracing innovation – the market innovates to meet pension savers’ needs.

- Bold and effective regulation – we are a bold and effective regulator.

To deliver on this commitment, we have developed a set of 19 saver outcomes (see Figure 1 below) that define our ambitions for savers and will guide the prioritisation and planning of our work. We will track our progress towards achieving these outcomes through a new set of key outcome indicators (KOIs) and monitor the impact of our combined activities using updated key performance indicators (KPIs).

Our Corporate Strategy was developed in the context of the long-term trends in the pensions landscape. We recognise that the landscape continues to evolve and that we and the industry we regulate must adapt to the challenges that face us so that together we enhance and protect pension savers’ outcomes.

- We continue to experience the impacts of COVID-19 in the economy, in our daily lives and across the pensions landscape.

- Global conflict is having a far-reaching humanitarian impact as well as exacerbating economic uncertainty.

- Economic challenges are driving inflation, heightening the cost of living pressures that result in a slow growth environment.

- Across everything we do, we must assess our actions against the unprecedented risk we face through climate change.

It is not possible to accurately predict how these challenges will play out, but we are prepared for an extended period of heightened global volatility. We continue to monitor external factors that may impact financial markets, the pensions industry and savers, and remain agile in our approach.

Employers and trustees are coping with ongoing financial pressures, and this strain is particularly acute in certain sectors of the economy. We stand ready to support all employers to comply with their pensions duties and to protect the security of their pension schemes. We also remain committed to support trustees in the effective running of schemes in savers’ interests.

We continue to develop a range of measures to protect the security of defined benefit (DB) scheme funding. These measures are designed to provide flexibility for individual schemes, while protecting savers’ money. We will use our powers against those who intentionally or recklessly avoid liabilities or put pension savings at risk. We have demonstrated that this applies to large and small schemes alike, through our recent use of anti-avoidance powers against SMT Scharf AG where a management buyout left the employers unable to support the pension scheme. We worked with global group Sanofi SA who will now meet their responsibilities for their UK-based DB pension scheme in the long term and we intervened with Keytec (GB) Limited to ensure that parent company Turbon AG provide meaningful long-term financial support for the scheme, publishing respective regulatory intervention reports in June and July 2021.

At times of financial strain, the risk of scams unfortunately increases. Together, we must stop the scourge of scammers. Trustees, administrators and scheme managers can demonstrate their commitment to this cause by signing up to our pledge to combat pension scams and over the next two years we will continue to actively drive up the number of schemes making this commitment and highlight how due diligence in the running of schemes can prevent scams. At TPR, we continue to work with our partners and industry to prevent pension scams and to take quick and robust action where they occur. This will include trialling new methods of prevention and disruption, working with our partners in the multi-agency taskforce Project Bloom.

Pension savers rely not only on their savings being secure, but also on the pensions system providing good value for money. Good value means that savings are suitably invested, costs and charges are reasonable, and services are of an appropriate quality. We are increasing our focus on value for money and working with the Department for Work and Pensions (DWP), the Financial Conduct Authority (FCA), regulatory partners and industry to realise these aims. This includes working closely with the DWP and FCA on a future consultation for a Value for Money Framework. We will also conduct a regulatory initiative to inform our work to regulate smaller DC schemes who must undertake a thorough value for money assessment – and consider their future if their assessment demonstrates they are not providing value for money for savers.

Decisions made on behalf of savers must be fair, transparent and in savers’ best interests. We want to see pension schemes manage the risks associated with climate change and the management of savers’ money to take account of environmental and social outcomes. Our Climate Change Strategy sets out how we intend to help trustees meet the challenges from climate change, and we published guidance on this in last year. We are all learning together and to that end we will update our guidance and publish further information where it is helpful to do so. We will continue to regulate in accordance with The Pension Schemes Act 2021 (PSA 2021) and the associated regulations that address climate change, with further reporting requirements being rolled out to include larger schemes from October 2022.

We want to see diverse and inclusive trustee boards make decisions that consider and represent all pension savers. We have set up industry working groups to tackle the barriers to diversity and inclusion across the industry and are leading the development of an action plan to drive this objective forward.

In our 2021 Equality Diversity and Inclusion (EDI) Strategy, we commit to improving our understanding of why pensions inequalities occur. We will work with government and industry to look at ways of reducing inequalities in saving. We also support the 2017 Automatic Enrolment Review proposals, which aim to open up workplace pensions to more savers.

As savers’ needs evolve, the market must adapt and innovate. We welcome innovation and the emergence of new scheme models – such as superfunds and collective defined contribution (CDC) schemes – as long as these vehicles offer a secure basis for achieving good outcomes for savers. We remain ready to assess potential superfund entrants to the market and we will be assessing CDC schemes for authorisation from August 2022.

Our successful future lies in being a data-led and digitally enabled organisation and it is clear that technology and continuous improvement go hand in hand. We are creating a Digital, Data and Technology directorate to develop and fully utilise our capabilities in data, digital and technology. This will help us regulate as efficiently as possible and organise ourselves around the effective use of data and technology to deliver better services, regulate more effectively and innovate to meet future challenges.

We have a vital job to do on behalf of millions of savers. This work is not possible without the TPR team. We have launched our People and Culture Strategy, which is built across three key areas: culture, leadership, and organisation and people. Culturally, we will build on our strengths, be driven by our values and be people-centred in everything we do. We have our sights set on inspirational leadership, strengthening our people and leadership skills to give us bold, flexible and empowering ways of working and our future generation of leaders. These areas of development are not mutually exclusive – our skilled, committed team of people will be powered by an inclusive and supportive workplace culture.

We continue to put the wellbeing of our team first. In these challenging times, it is vital that each and every one of our team can balance the commitments and pressures of everyday life with the requirements of work, is supported and able to thrive. Our people are the foundation of all that we continue to achieve, working together to put the saver at the heart of what we do.

Our purpose: current and future context and the outcomes we pursue for savers

Our primary goal is to protect the money that savers invest in pensions. Last year, our Corporate Plan set out an activity roadmap for 2021 to 2024, anchored in our strategic priorities. We are now entering the second year of this journey, and while we and the rest of society are still absorbing the impact caused by the pandemic and other global challenges, we remain committed to the course we have set.

An important step forward for us last year was defining the outcomes we want to achieve for savers within each of our strategic priority areas. Our saver outcomes make it clear what every saver should expect of us and are a powerful tool in guiding our work and anchoring our strategy in our day-to-day operations. We do not have sole ownership of these outcomes however, and in our work to achieve them we recognise the shared responsibility we have with central government, our regulatory family, our partners and industry, in working together to achieve them.

Figure 1: Our strategic priorities, goals and saver outcomes

Read a transcript of Figure 1.

Managing risk and strategic direction

The economic environment

Two years after the start of the COVID-19 pandemic, economic conditions for the UK and the rest of the world remain uncertain. While the economy has been reopening, recovery is constrained by a tight labour market, supply-chain disruptions and rising inflationary pressures that have resulted from significantly higher global energy prices. This picture is undoubtedly exacerbated by the impact of the Russian invasion of Ukraine.

We are entering a year in which inflation is expected to rise to its highest level in decades, and a real-terms fall in incomes that is potentially the greatest since the 1950s. This is likely to suppress UK growth in 2022.

Employers are under increased pressure because of rising costs, the fall in consumer demand and, especially in sectors already weakened through the pandemic, more challenging credit environments. We expect this will result in increased business insolvencies. Meanwhile, savers will be experiencing increases in their cost of living. In addition, we have seen increased merger and acquisition activity over the last year, which has potential to impact schemes, particularly where transactions are funded by high leverage. Financial insecurity also increases saver vulnerability to pensions scams.

The pensions landscape

Our strategy identifies a number of trends that are shaping the pensions landscape. We continue to monitor the development of this picture, adapting and enhancing our approach, considering the constraints and opportunities of the time.

- The pace of change in the ways we work has accelerated rapidly during the pandemic. People are working more flexibly than ever before, and combined with the impact of economic challenges, we expect saving habits will change too.

- Employers may seek to revise their operations and investments during economically difficult times. We expect increased corporate distress as well as restructuring, mergers and acquisitions.

- While DB memberships – relative to DC – continue to reduce, they remain sizeable, the assets under management are still significant and DB pensions will continue to be paid for many years to come. We continue to monitor the health of these schemes, intervening where necessary to ensure the security of savers’ money.

- The balance of the marketplace is shifting as consolidation continues. We are seeing – among schemes and the professional trustee market – significant growth in professional trustees, including sole trusteeships. This shift has implications for schemes, in terms of how decisions are made in savers’ best interests and the opportunity to drive up standards of pension scheme governance.

- The DC market is growing and consolidating, with the total number of non-micro schemes and hybrid schemes (10+ members) having declined by 63% from 3,660 to 1,370 since the beginning of 2012. We continue to support consolidation where it improves the security and value that savers receive.

- We are seeing innovation in the market, with the emergence of new scheme types. We have put in place an interim regime for superfunds, under which these schemes will be assessed against our published guidance in key areas, to ensure the protection of savers who are transferring. One superfund has successfully met the first phase of expectations set out in our interim guidance and we will continue to work with the DWP to develop appropriate legislation. In addition, we will work with the DWP to develop the regulations, authorisation and supervision framework for CDC schemes.

- Digital, data and technology will drive and enable change. The development of pensions dashboards will drive an increased focus on administration and investment in technology in the market, increasing transparency and changing the way that savers engage with their pensions.

- Regulatory frameworks will evolve, including in areas such as climate change where we can expect significant change. This is driven by legislation and increased saver interest in social and environmental factors.

Our strategic priorities and two-year roadmap

Our three-year Corporate Plan published last year described our main areas of focus under each strategic priority for year 1 (2021 to 2022) and how we intended to progress these priorities across years 2 and 3 (2022 to 2023 and 2023 to 2024). We are one year into a three-year corporate period so will refer where relevant to the progress we have made in our activity over 2021 to 2022 to provide context for the roadmap described for the remaining two years.

We face the ongoing challenge about how we allocate our budget and resources to prioritise activity across all our commitments. We recognise the need to meet our responsibilities in the most effective and efficient way possible to deliver on our ambitions and protect savers in the long term.

Security

Year 2 (2022 to 2023)

New powers

The PSA 2021 introduced a strong package of enforcement measures which came into force on 1 October 2021.

We will be implementing and embedding the package of new powers, including the additional implementation of changes to the notifiable events regime with the aim of reinforcing it as an early warning system. Timing is yet to be confirmed but they will become operational in due course.

Cyber security

Our 2018 cyber security principles set out a risk assessment cycle for data protection and cyber security. This guidance outlines the ongoing review and risk mitigation process expectations, and the key governance requirements and controls, with links to other sources of information, including the Information Commissioner’s Office guidance on IT security. These principles continue to guide our expectations of what trustees and scheme managers must do to protect savers’ data and scheme integrity.

Last year’s Corporate Plan confirmed that we would continue to consider and develop our work in this area in order to mitigate the risks associated with cyber security. Our master trust authorisation criteria includes an expectation that cyber defence mechanisms are in place. The pilot we undertook with one administrator gathered information on three themes: systems and automation, data quality / trustee focus, and understanding / willingness to pay.

As we move through 2022, our administrator relationships team is in a period of information gathering and review, with our pilot activity due to run until the end of December 2022. Other areas of focus will be introduced in a wider roll-out beyond December 2022, if an assessment of the pilot determines that it delivered value.

Scams

The fight to prevent savers losing out to scammers continues and in last year’s plan we confirmed that we would need to keep our approaches under review. We remain concerned that savers are at heightened risk because of increasing pressure on their personal finances. Our work will therefore continue to deliver communications that flag clear warnings for savers, encouraging them to seek readily available guidance and report their concerns to Action Fraud. We will continue to encourage pension schemes to sign up to the Pledge, which demonstrates a commitment by those running schemes to put processes in place (if they have not already done so) that actively mitigate scams risks for savers, as per the Pension Scams Industry Group (PSIG) Code.

The PSA 2021 includes regulations that introduced a system of red and amber flags, which mean that trustees can halt suspicious transfers. We introduced guidance in November 2021 helping trustees get to grips with how they can use their new power to refuse the transfer of funds out of a scheme where there is a heightened risk it may be part of a scam. This development in the ‘first line of defence’ against scammers reflects two key components of the Pledge against Scams in terms of the due diligence that should be exercised within schemes by trustees and warnings that should be issued to savers. We also believe that for trustees, administrators and providers, failure to report suspected scams amounts to a failure to protect savers.

We will continue to take action to lock up fraudsters, a recent example being the sentencing of two individuals A Barratt and S Dalton who have admitted charges of fraud by abuse of position as trustees and have been sentenced for a total of 10 years.

We have developed our revised Pension Scams Strategy that will be published during 2022. The strategy has been developed in discussion with key partners and stakeholders including PSIG and will set out a roadmap for future activity. We have taken account of how we have tackled pension scams to date and the impact that we have had – including a consideration of how we can best deploy the combined efforts of the multi-agency group Project Bloom (which already has an embedded strategic action plan in place). We remain invested in Project Bloom for the long term and we continue to chair and administer the group as it is clear that a multi-agency approach remains the most effective and efficient way to continue prevention, disruption and enforcement against those who attempt to scam savers.

Given what we have learned about the deployment and impact of different prevention and disruption techniques, it is right that while we maintain the work we already do within our intelligence and enforcement teams we also keep all our activity – and its effectiveness – under review. We will also challenge ourselves and our Bloom partners to develop and pilot new disruption techniques. We see how scammers are constantly evolving and our own assessment and development forms a key area of activity for us as we move through 2022.

Supervision

Supervision is the way we maintain relationships with trustees, managers and sponsoring employers of pension schemes, and allows us to work together to identify risks and mitigate them before issues occur. Our process allows us to monitor schemes, clarify our expectations and take swift action where appropriate. Our event-driven supervision has been extremely high over the last year, with 281 individual engagements representing 280% over our forecasted activity. This means we have had to rapidly assess each situation as it arises and act accordingly.

We engage proactively with DB, DC and public sector schemes through relationship supervision to help promote higher standards of governance, administration and, for DB schemes, secure funding. Our team has also undertaken an outreach programme with administrators, increasing the number of savers in schemes who are in relationship supervision via a pilot project with a third-party administrator. We will continue to build on our work in this area by including a further three administrators into the programme during 2022 to 2023. We will continue to assess superfunds wishing to enter the market against the expectations set out in our interim guidance (June 2020) and we will also be ready to accept any potential CDC schemes into authorisation assessment from 1 August, as detailed in our Innovation section below.

We have a number of new compliance-based requirements for schemes from 2022 onwards, including the Task Force on Climate-Related Disclosures (TCFD) reports in relation to schemes’ climate change disclosure responsibilities, the Competition and Markets Authority regulations and the new value for money reporting requirements. We expand on these under the relevant strategic priority sections below.

Our work continues to include applications such as clearance and regulated apportionment arrangements. These are subject to prompt review as we recognise the timescales of underlying transactions may be urgent.

There are now 36 master trusts in the market and since January 2021 we have seen an increase of memberships by approximately 10%, which now stand at 20.7 million. This represents 94.5% of total DC scheme memberships alongside an increase in assets of nearly 50% from £52.7 billion to £78.8 billion. It is therefore critical that we continue to supervise master trusts in a robust, effective way to ensure they remain stable and continue to demonstrate high standards of governance. We will assess any potential new master trusts against our authorisation criteria, and for those in operation we continue to require them to complete a supervisory return alongside their other obligations under the master trust regime. We use this annual statutory request for information as part of our ongoing assessment of schemes, to assess and evidence whether they meet the required standards and should remain authorised. We concluded the final COVID-19 impact questionnaire last summer, which highlighted some scheme-specific considerations that were addressed at the time.

The work of our internal master trust expert risk panel involves understanding and assessing market-wide risks and recommending potential mitigations. The panel now has an operational industry-level financial dashboard and investment modelling tool. This has significantly improved our ability to monitor industry performance, and allow us to analyse and track emerging or inherent strategic risks within the industry and inform potential mitigations.

Automatic enrolment (AE) and DC provision

We recognise that the needs of and challenges faced by different savers vary for many reasons, including the type of pension they have available to them to provide income in retirement (on the basis they do not opt for early release).

In our Corporate Plan last year, we confirmed we would ‘continue to work with trustees, employers, providers, the DWP and the FCA to achieve consistent quality standards and levels of member protection across all work-based DC pensions’. This is now a market with 27,700 schemes with 21.9 million saver memberships. It is subject to ongoing change with the rate of consolidation nearing 40% over the last 10 years. This reinforces the need for our regulatory approaches to support larger, more stable schemes that meet higher standards of governance and offer good value for money. In this way we can ensure we are protecting DC savers in the most effective way possible.

We did not see an immediate reduction in levels of AE compliance as a result of the pandemic, but we monitor any shifts on an ongoing basis. The DWP’s statistical report: Workplace participation and savings trends: 2009 to 2020 was published on 2 September 2021 and shows how trends in pensions contributions remained relatively stable over the COVID-19 period. We also saw compliance with the law remaining high, including maintaining pensions contributions.

The government’s package of COVID-19 support for businesses concluded at the end of September 2021 and we recognise that many employers continue to struggle as a result of the pandemic and the current economic climate. However, we remain clear that employers must not neglect their AE duties. This includes when they first apply and at the three-yearly re-enrolment point. We continue our digital communications campaign to highlight the legal requirements for employers and make it easy for them to find the relevant content on our website.

We remain aware that employers in certain sectors such as food and accommodation, farming, wholesale and retail continue to face particular challenges as a result of the pandemic and ongoing economic volatility, and we continue to consider how we can best help these employers avoid non-compliance. We have previously raised our concerns that as the ‘gig economy’ is set to continue to grow, eligible workers should be automatically enrolled into a pension to avoid a savings crisis. We welcome recent moves by some employers in the gig economy to include their staff in workplace pensions and continue to carefully monitor this sector. We take enforcement action to protect all savers. Our statutory powers include issuing compliance notices, civil penalties, and removing and appointing trustees. We will also use our powers under section 89 of the Pensions Act 2004, publishing information on cases where we have exercised or considered exercising our powers.

Regulatory initiatives (RIs) are project-based pieces of work where we engage with a number of schemes or employers in relation to a particular risk, potentially taking action against those that have not taken appropriate steps to address the risks we have identified. We are planning to start five RIs during 2022 to 2023, the detail of which are covered in the relevant sections below. The first of these initiatives has its focus on the accuracy of contributions and will commence during 2022.

We will continue casework in respect of AE and will also review how we currently undertake our bulk enforcement process, to develop a more agile model to better handle volume peaks where possible. Our rolling programme of compliance validation inspections target all sizes of employer to check ongoing compliance with AE, and we are further developing our ability to target non-compliance based on risk and issues assessment. Our inspections remain part of our ongoing activity and can be desk-based or in-person visits. Given the differences across sectors – particularly in the complex economic climate as highlighted above – we will continue to develop regular quarterly sectoral views, focused on sectors of (potential) high risk.

Our operation includes ongoing activity to monitor and recover missing contributions from DC schemes and acting on the basis of reports we receive concerning material payment failures directly with employers. We use our reporting portal and other triggers to identify late and / or missing payments and we actively manage changes to our risk bar to reflect any changes in our risk appetite as we did during 2020 as part of our easements package for employers as a result of COVID-19. We continue to work proactively with providers to assess performance, ensure performance is maintained, and identify areas of concern before major problems develop. We will also continue our dialogue with the DWP regarding future policy developments.

Year 3 (2023 to 2024)

Supervision and enforcement

Key components of the PSA 2021 will have already been implemented or will be during the year. This includes our readiness (which will be embedded in our existing work by this point) to review applications for authorisation from potential CDC schemes, ongoing supervision of any CDC schemes that have been authorised to ensure that high standards of operation remain in place, and the new DB funding code coming into operation. We expect to be supervising against the new DB funding code from autumn 2023.

We have been regulating against many of the provisions made in the PSA 2021 since October 2021 (with the exception of areas requiring secondary legislation to come into effect scheduled for 2022 to 2023) and they will continue to have an impact on our enforcement activity as we continue to embed them over time.

Cyber security

We will continue to engage with key areas of the market in relation to cyber risk and discuss steps that can be taken to assess risk and develop resilience. Further development will be needed if we are to keep pace with developments in this area as different threats emerge and technological developments provide threats and opportunities.

Scams

During 2023, we plan to roll out activity identified in our Scams Strategy alongside testing alternative disruption techniques and the ongoing work of Project Bloom. The focus on trustee, administrator and provider due diligence in the actions they take to mitigate the risks associated with pension scams within their schemes will ramp up. We also expect more schemes to take the Scams Pledge, confirming that they self-certify against a set of criteria to combat scams.

AE and DC provision

From a compliance and enforcement perspective, we anticipate that the economic situation and rapidly rising costs for businesses will present a significant compliance challenge, including potential hardship, which could result in an increase in our case volumes and activities. We also anticipate that implementation of the 2017 AE Review measures will require us to consider what activities and plans we need to develop in order to meet any recommendations that are made to support continued employer compliance.

Value for money

We believe savers’ money must be suitably invested, costs and charges must be reasonable and good quality services and administration are provided to all.

Year 2 (2022 to 2023)

In 2018, we published a joint strategy with the FCA that identified value for money as a priority area of focus. Setting out this priority was particularly important given the number of savers now in DC schemes and the fact that reported assets stand at £113.5 billion, up 30% from the previous year and 413% since the start of 2012. The rate of consolidation continues at the same time as new regulations, which came into force from 1 October 2021, require DC schemes with less than £100 million in assets to prepare a rigorous value for members assessment. Where trustees are not able to demonstrate their scheme provides value, they must wind up and transfer their members to an alternative or explain why confirming the improvements they will be making to ensure the scheme is good value.

Savers are right to expect – and are entitled to – good value for their money. It should be suitably invested, incur reasonable costs and charges, with robust data driving good quality services and administration. During 2021 we increased our focus in this area, developing a broader understanding of how value for money can be assessed.

Our aim is to drive a long-term focus on value for money across the pensions market. This includes trustees disclosing information on key components such as investment performance and scheme oversight – which in turn includes areas such as data quality, communications and costs and charges. Trustees and independent governance committees will then be able to compare these things with schemes offered by other providers.

We remain clear that this is just the starting point, and we will continue to work in partnership with the DWP and other regulators and stakeholders to achieve good value for DC savers. We received 61 responses to our joint discussion paper with the FCA: developing a common framework for measuring value for money in DC schemes, up to the deadline for feedback of 10 December 2021. We published a statement based on the feedback received from the discussion paper in June 2022. We will use the feedback to help shape the assessment framework, continuing to work closely with the DWP and FCA on a future consultation which should be published by the end of the year.

Trustees of schemes with under £100 million of assets who must now undertake a ‘holistic’ assessment to assess how their schemes provide value for money are provided with a range of self-assessment criteria, with the assessment outcome reportable via the scheme’s annual chair’s statement. Statutory guidance has been provided on GOV.UK in relation to the new requirements applicable for some schemes, as well as how a comparison against other schemes might be undertaken. We will start a RI this year, which will assess how we may identify and address instances of non-compliance and how we will engage with schemes who need to make improvements, schemes that have confirmed they offer good value for money, and schemes that will consolidate.

Year 3 (2023 to 2024)

Our work to regulate value for money requirements on trustees as outlined above will continue.

During 2023 to 2024 we will take forward the work resulting from our RI in terms of implementing our regulating non-compliance, engaging with schemes where improvements are needed and where good value for money has been confirmed.

Scrutiny of decision-making

Year 2 (2022 to 2023)

Supporting good decision-making for trustees, employers and savers

It remains the case that the decisions trustees and employers make are vitally important to all savers in all types of pension schemes. It is also equally important that we support savers so they can make good decisions about their retirement savings and achieve the best possible outcome.

Savers are unlikely to know or care whose regulatory remit they fall under, but will want to know that their savings will be protected. We are determined to be part of a clear and coherent regulatory environment that helps industry deliver good outcomes for savers. The joint FCA-TPR Regulatory Strategy published in 2018 brought our organisations closer together and working hand-in-hand is now very much the norm. We plan to publish an update to the joint strategy in the second half of 2022 which will outline the shared strategic outcomes that will continue to draw our focus in the years ahead. Working with our regulatory family, we will also come to a common understanding of shared issues and co-ordinate joint responses through the Wider Implications Framework.

We issued a call for input with the FCA in May 2021 to seek views about what more we can do to help consumers engage with pensions so they can make informed decisions, leading to better saving outcomes. It included identifying areas where greater levels of support and guidance may be needed, to help employers and trustees in making good decisions, which in turn improves and protects saver outcomes. In the call for input we confirm that the time for this work is now as there are 15 times as many savers in accumulation within DC schemes than in accumulation within DB schemes. The resulting risk arising from this shift is that a significantly greater number of savers are now responsible for decisions in planning their retirement through their working lives and as they approach retirement. There are potentially serious implications for savers if these decisions are ill-informed.

We are developing a journey, from joining the workforce to retirement, to better understand what influences savers and where they can best benefit from support, and the input from industry will help shape future RIs.

During 2022 we will publish our new code of practice. This will combine the content of our existing 15 codes into one online document and is specifically designed to be easier for trustees, advisers and employers to understand and navigate.

The development of the DB funding code

Following our first consultation on a forthcoming DB funding code of practice during 2020, we confirmed our plan to run a second consultation to fully explore all the potential implications of the principles established through our first consultation – principles that we believe remain the right ones.

We have been clear that we are taking the time we need to develop the right shape for our DB funding code and that we want to take the opportunity to learn from the DWP’s consultation on draft funding and investment regulations. On the basis that the DWP consults on its draft funding and investment regulations in spring 2022, we are planning to launch our second consultation in the autumn of 2022, with our new code becoming operational from September 2023 – but these timings remain subject to change. We have previously explained that resulting changes from the new code will be forward-looking, which means that schemes with valuation effective dates on or after the code’s commencement date will be affected. It is possible that we may undertake a RI ahead of the code becoming operational, with the potential for a focus on scheme management of risk and resulting covenant strength.

Improving trustee board equality, diversity, and inclusion

We published our Equality, Diversity and Inclusion Strategy in June 2021, having developed it in dialogue with a range of organisations across the pensions industry. The strategy explains how we are going to embed diversity and inclusion across TPR and support the regulated community to follow suit. It also provides a roadmap and sets out strategic aims that we commit to achieving between now and 2025, with clear objectives supporting each aim.

Our Corporate Strategy specifically addresses the need to improve EDI within our regulated community and along with our industry working group we will be creating an action plan in the first half of 2022. This will set out how we plan to support the development of more diverse and inclusive boards of trustees / managers by improving data and how to share resources and best practice in the long term.

We will also lead a RI to establish a current baseline of board diversity from which to build our programme of work, clearly set our expectations and develop and share best practice created by the group.

Active and responsible approaches to tackle climate change

From October 2022, trustees of schemes with £1 billion or more in assets will be required to comply with the climate change regulations. We continue to build effective resources and skills to regulate against the new requirements including our approach to enforcement. In 2022 to 2023 we will continue to implement the PSA 2021 requirements on climate change, including assessing TCFD reports for the largest schemes and master trusts, which we expect to receive between the spring and autumn. We will also be supporting the second tranche of schemes (£1 billion or more in assets) for TCFD reporting and supporting any new requirements that the DWP may introduce.

During the remaining two years of this plan, we will develop a RI focused on the ESG / investment regulations concerning the publication by schemes of compliant statements of investment principles and implementation statements. This will include the scoping and design of our approach for high volume engagement with schemes (which will include those smaller schemes not currently under the requirements of the TCFD requirements) so we can check compliance. We will design our enforcement approach around breaches and provide information and examples of best practice to trustees. As set out in our Climate Change Strategy, we will work collaboratively with industry, especially as these requirements and the data to support trustees develops.

Year 3 (2023 to 2024)

Supporting good decision-making for trustees, employers and savers

The extent to which good decisions can be made in the interests of savers depends on the availability of comparable information so trustees can assess the value for money offered by their scheme against that offered by other schemes. This will enable them to ensure that they are offering the best value for money for the savers they represent. Our work with the FCA and DWP to develop the Value for Money Framework and the resulting pension scheme value for money disclosures will create greater transparency and drive competition on performance because comparisons can be made.

Improving trustee board equality, diversity, and inclusion

During 2023 to 2024 we will continue to deliver the activity set out in our action plan developed over the year ahead, working in collaboration with our regulated community and our industry working group. As mentioned above, this is likely to include working to improve data on diversity and inclusivity, setting out what our expectations are of schemes, employers and trustees, and providing the tools, guidance and support to meet and exceed those expectations.

Active and responsible approaches to tackle climate change

We will continue to work with the DWP, other government departments and regulators as the regulatory landscape relating to sustainability and climate change continues to change. For example, during this period the government has expressed its ambitions to introduce new Sustainable Finance Disclosures across the financial sector, and the DWP has confirmed that during 2023 it will consider how and whether climate change measures should be applied to smaller schemes. During 2023 to 2024 we will build on the developmental work described above, sharing what we are learning and supporting trustees to build effective risk management and resilience.

Embracing innovation

Year 2 (2022 to 2023)

Developing pensions dashboards

The PSA 2021 created the legislative framework for pension schemes to provide data to savers through pensions dashboards, so savers can see all their pension arrangements together in one place. This will empower them to make important and informed decisions that could enhance their retirement savings. The detail will be confirmed in secondary legislation by the DWP and standards will be published by the Pensions Dashboards Programme (PDP) at the Money and Pensions Service in 2022. Schemes’ duties will be staged over time, with the largest schemes connecting to dashboards from April 2023.

During 2022 to 2023 we will continue to work with the PDP, DWP and FCA as the legislative and technological frameworks are set. We will also launch our programme of education, highlighting the steps that schemes need to take to meet their dashboard duties, including what data to prepare to be ‘dashboard ready'.

This programme will include guidance on our website, industry engagement, and one-to-one communications to each scheme at least 12 months ahead of their connection deadline. We will work with the PDP and FCA to monitor the progress industry is making in preparing for the new duties, and we will work collaboratively with industry to resolve any challenges.

We will consult on our Compliance and Enforcement Policy, and develop our internal systems and processes, ready for regulating compliance from June 2023.

Superfunds and other innovative DB models

We continue to engage with those preparing or considering developing innovative DB models, including superfunds. Our guidance sets out the standards we expect to be met by any potential superfund seeking to enter the market until legislation is in place. We will prepare for our three-year review of certain elements of the guidance, as committed to when it was first published.

Progress in this area of the market is being made and there are other DB-alternative models emerging, for example those offering capital-backed journey plans or alternative consolidation options which don’t sever the link to the employer. We expect these options to start to be more established in the market. We will continue to engage with these models to understand them better and, if needed, assess how and if they are fit to enter the market through our Supervision team. We will consider what interventions – such as guidance to trustees and the market – are needed to help ensure that those innovating and those considering moving into these vehicles do so in the best interests of savers.

In November 2021 we published the name of the first superfund that met the first phase of the expectations set out in our June 2020 guidance. We will supervise this scheme and consider any proposals for transfers, whilst continuing to assess other potential market entrants. As a regulator, we must strike a balance between supporting innovation and supporting opportunities for the market to create the best possible options for savers, and ensuring new models represent an acceptable level of risk and meet savers’ expectations and needs.

We continue to work with government to consider a legislative solution in the longer term.

CDC schemes

We have stated before that we believe CDC schemes have the potential to change the pensions landscape by offering a viable alternative option to traditional DB and DC pension schemes. The DWP introduced legislation by publishing the regulations in December 2021, and in January 2022 we launched an eight-week consultation on our code of practice, which closed in March. We published our final code and consultation response in June this year, and this explains how trustees can apply for authorisation and how we will assess schemes against our authorisation criteria – both at the point of application and through our ongoing supervision of authorised schemes. Trustees will be able to apply from 1 August this year and our code will help trustees and employers plan ahead by setting out how we will assess the criteria set out in legislation.

We will be looking at any necessary changes to the code and guidance so that we clearly set out our expectations for scheme closure and wind-up.

Year 3 (2023 to 2024)

Developing pensions dashboards

In 2023 to 2024, schemes will start to connect to dashboards, and we will be monitoring and enforcing schemes’ compliance with their connection deadlines. We will evolve our products and processes as we learn from the experience of the first schemes to connect, continue to monitor industry progress towards dashboard readiness, and continue to educate trustees, shifting our focus over that year towards medium-sized schemes who are expected to connect from autumn 2024.

Superfunds and other innovative DB models

As cited above, we recognise that superfunds are not the only potential models for consolidation of DB schemes. We expect the market to have continued to develop, a wider set of options and opportunities for trustees and employers to have emerged, and a number of schemes to have transacted with these. We expect some of these options to be more established and form a more regular part of trustees’ considerations in respect of their schemes. We will continue to engage with prospective providers, undertake research and analysis in this area, assess the risks, and build a picture of our expectations so we can ensure that any new DB scheme models meet savers’ needs. We will complete the review of certain elements of our superfund guidance and produce any further guidance on the broader landscape of options as necessary.

CDC schemes

We anticipate a further round of activity to support a new set of amended regulations, which will enable a broader market for CDC schemes to be established. The DWP has indicated it will consult towards the end of this year and the full scope of work will not be confirmed until this consultation has taken place. The extended authorisation framework could include multi-employer, industry-wide, commercial vehicles and decumulation arrangements. Once the extent of the expanded framework is clear, we will be able to understand the implications for operational delivery, including the potential number of applications, and revised code and guidance.

If, by this time, we have an authorised CDC scheme operating in the market, we will then move into ongoing supervision, including the first CDC scheme return and supervisory return.

Bold and effective regulation

In last year’s Corporate Plan, we described our activity in pursuit of being a ‘bold and effective regulator’ in two key areas:

- delivering and completing major change programmes

- completing our system upgrades

We concluded our exit from our Capita contract in respect of AE services as planned in September 2021. We have moved and maintained these services successfully in-house and via a new contact centre contract. We also delivered planned major upgrades to our internal and external IT systems that we set out in last year’s Corporate Plan.

In the light of the long-term journey set out in our Corporate Strategy, we are clear that change does not happen overnight. We are focused on the challenges ahead and recognise that there remains much work to do to enhance and protect the outcomes of all savers.

It is vital that as we evolve and adapt to the changes around us, we continue to balance our focus, taking action where we can make the most difference and where it benefits savers. The revised priority areas in this section reflect the breadth of activity we need to deliver to support the effective running of our organisation, given:

- our role as a regulator

- the world around us

Year 2 (2022 to 2023)

Our role as a regulator

We have six statutory objectives, which provide our mandate. The work we do is guided by the Better Regulation Framework and the Regulator’s Code. Within this framework we are resourced to manage corporate governance, risk and assurance, internal audit, information security and compliance, IT security and business continuity. These capabilities reflect the increasing levels of responsibility we have been given and enable us to manage the standards and risks within our own organisation whilst remaining fully accountable as an arm’s length regulatory body. In the coming year, the work in this area will include responding to both an independent review and a board effectiveness review. We continue to assess our operational effectiveness and find ways to improve it.

For some time, we have been considering our future needs in terms of office space to plan for the end of our current lease in 2023. Given what we have all learned about working from home as a result of the pandemic, we will be testing a hybrid way of working over the course of 2022 and that will inform our future working model. We continue to prepare for our future location from July 2023.

We manage a portfolio of change programmes and projects and in last year’s Corporate Plan we set out a significant programme of IT development, the bulk of which has now been completed. There are updates to our DB and DC scheme return and these will be delivered during years 2 and 3 of this Corporate Plan period. Delivering against our change portfolio commitments will enable us to be efficient, effective and data-driven in the long term but requires ongoing resource and commitment.

Following the conclusion of the AE contract with Capita, we continue to develop our operational capability across formal projects and continuous improvement. This includes upgrading the systems we use for our day-to-day work and taking steps to improve the systems we use for data and case management work. We will complete a major review of our AE Operational Strategy and long-term roadmap, moving to a delivery phase where we will take account of the AE 2017 Review recommendations and other potential policy changes.

The world around us

Our 2021 Climate Adaptation Report sets eight areas of focus that will reduce our environmental impact, manage climate risks and adapt to new conditions as per our Climate Change Strategy. We report annually on our performance against the Greening Government Commitments 2021 to 2025. We need to improve our resilience to the impacts of climate change and have set out that we will:

- achieve net-zero carbon emissions by 2030 and over the next three years we will set out our plans to achieve this

- report in line with the TCFD recommendations where we can and in doing so, we are aligning ourselves with the approach used across the financial sector

Year 3 (2023 to 2024)

Our role as a regulator

Our direction of travel will continue to reflect the strategic choices we make and the risks we see emerge. The way we operate will retain a firm basis in the Better Regulation Framework and the Regulators’ Code, and that will include ongoing and continuous improvement in the way that we govern ourselves against our statutory objectives. This will include assessing and acting on the results of the independent review, and assessing and improving our governance framework, information security and compliance, and IT security. We will have further developed approaches to meeting government Functional Standards and cyber security.

We will continue to devote time, resource and budget to delivering operational effectiveness through our change portfolio and as part of this, we will keep our IT estate under review, making improvements and upgrades as appropriate. This will be driven in part by our Digital Data and Technology team as it establishes itself. This will include externally facing updates to DB and DC scheme return, available via Exchange.

The world around us

As mentioned above, we have set a 2030 net zero carbon emissions target for TPR. We will demonstrate that we are taking part in the transition and that will include setting out our plans to achieve our 2030 target by 2024.

Measuring our performance and tracking our progress

Our Corporate Strategy sets out our long-term objectives for pension savers, and it is vital that we plan our activity to achieve these objectives against a clear set of goals. To do this, we have developed a set of saver outcomes. These are the outcomes we will pursue for savers within each of our five strategic priorities.

We have reviewed and updated our performance measurement framework to align with these outcomes, providing a clear line of sight between our strategic ambitions and how we evaluate our work and its impact. These are a new set of measures and the first time we have established a means of tracking progress against our Corporate Strategy, so we will further develop them – and our capability to measure them – in the months and years ahead.

- Our KOIs are long-term measures that allow us to track our progress towards the saver outcomes over time.

- Our KPIs are annual measures that enable us to track the performance of our prioritised activities, and adjust as necessary, within any given year.

We additionally use market tracking measures to monitor the shape and overall trends within the pensions landscape. These measures help us identify emerging risks so we can respond in a timely and effective manner, based upon the evidence that is emerging both in the marketplace and the wider economy.

Table 1: Key outcome indicators under strategic priority

| Strategic priority | Key outcome indicator |

|---|---|

| Security |

DC savers get the pensions they are entitled to because a high proportion of eligible workers are saving into qualifying schemes. |

|

Regulation of the master trust market as it evolves ensures that savers receive their pensions because:

|

|

| DB savers’ money is more secure because schemes are appropriately funded and carry an acceptable level of risk and volatility. | |

|

Savers are being actively protected from scammers because:

|

|

| Value for money | We drive improvements in the value for money savers receive because TPR and trustees know whether schemes represent good value and trustees take appropriate action as a result of carrying out the value for members assessment. |

| A common value for money assessment framework improves understanding and comparisons of value which ultimately drives improvements in value for money for savers. |

|

| Improvements in data quality and automation, including as a result of preparations for pensions dashboards, drive improved services for savers. |

|

| Decision-making |

We monitor the proportion of savers in schemes that demonstrate good governance and take mitigating action where savers’ exposure to risks caused by poor governance is too high. |

| By driving trustee action on the risks and opportunities from climate change and in line with our Climate Change Strategy, we help ensure the management of savers’ money takes account of environmental and social outcomes. |

|

|

We develop enhanced understanding of the challenges faced by trustee boards in broadening the diversity of their makeup, working with industry to ensure that diverse and inclusive trustee boards make good decisions for savers by:

|

|

| Effective implementation of the new DB Funding Code will increase awareness and understanding of what is expected of trustees when approaching funding and investment, which will drive intention to comply with our expectations on long-term planning and risk management. |

|

| By bringing information into one place, pensions dashboards support savers in making the most of advice and guidance. |

|

| Innovation |

We authorise any CDC schemes which meet legislative quality criteria and supervise them on an ongoing basis to protect savers’ benefits in the longer term. |

| DB savers get the money promised to them because we ensure that active superfunds operate at an appropriate standard now and in future and we review trustees’ decision-making around transfer to a superfund. |

|

| As pensions dashboards go live, more savers are able to better interact with their savings and begin to be reunited with lost pots. |

|

| Bold and effective regulation |

Savers get improved value for money from TPR as demonstrated through our internal value metrics. |

| Our people increasingly drive and deliver bold and effective regulation because of the shifts made through our People and Culture Strategy in relation to our people and organisation, our leadership, and our culture. |

|

| Savers get better value for money from TPR because digital, data and technology improves both our regulatory and operational activities. |

|

| We are reducing our environmental impact, evidencing progress against the Greening Government Commitments and the objectives in our Climate Change Strategy, and we are improving the sustainability of our operations. We set a 2030 net zero carbon emissions target for TPR and by 2024 we will set out our plans to achieve this. |

Table 2: Key performance indicators under strategic priority

| Strategic priority | Key performance indicator |

|---|---|

| Security |

Employers continue to re-declare and new employers make their declarations for the first time in line with their duties for AE. |

| Employers make contributions to schemes before they become significant late payments. |

|

| We will implement the new elements of the PSA 2021 and track benefits realisation. |

|

| We will develop and implement the new funding code in line with milestones agreed with the DWP. |

|

| We will ensure that risks or areas of focus identified through relationship supervision will be addressed by schemes in a timely manner, meaning recommendations made in our supervisory reports are promptly addressed. |

|

| We evolve our approach to the prevention and disruption of pension scams by maintaining preventative activity, including further embedding the Scams Pledge, and trialling new disruption techniques. |

|

| Value for money |

We develop a regulatory initiative to regulate against the new value for members assessment. |

| A consultation on a holistic Value for Money Framework is launched working closely with the FCA and the DWP. |

|

| Multiple communications are issued directly to all schemes in the 12 months ahead of their dashboard connection deadlines, emphasising the actions they need to take in respect of systems and data quality. |

|

| Decision-making |

The new code of practice is published, clearly setting out governance requirements, and we are seeing an increase in its use over time which enhances governance standards and reduces instances of poor governance. |

| We will develop a regulatory initiative to assess compliance with the new climate-related requirements for statement of investment principles and implementation reports. |

|

| We will set out our action plan and confirm the expectations we have of trustees. We will then develop a mechanism by which we can establish a baseline of the current equality, diversity and inclusivity of trustee boards, working with our regulated community and industry working group. |

|

| Further to the DWP’s consultation on the draft funding and investment regulations being published, we will undertake our second consultation on the draft DB funding code. |

|

| From 2023 to 2024, we will introduce measures to promote and track the coverage of savers’ scheme memberships on pensions dashboards. |

|

| Innovation |

A CDC authorisation and supervision regime is developed, ready and implemented so that the first authorisation decision can be made. |

| We will continue to apply the interim regime for DB superfunds in the period before specific legislation is in force and will assess applications within strict timescales. |

|

| Following our communications, the first schemes to implement their dashboard duties from 2023 are prepared and taking action and, from 2023 to 2024, we will take appropriate action where we see schemes failing under their duties. |

|

| Bold and effective regulation |

We develop and implement a robust internal Value for Money Framework that enables us to gauge and improve the value we provide. |

| We maintain performance across employer and scheme-facing services, ensuring prompt and responsive communications with our regulated community. |

|

| Our People and Culture Strategy is launched and delivers its key year 1 and year 2 objectives, with progress demonstrated through our staff survey. |

|

| Our Digital, Data and Technology directorate is implemented successfully. |

|

| We have high employee engagement. |

|

| Our team is able to work effectively, whether that is solely at home, solely in the office or a combination of both. |

|

| We measure and report on our environmental impact in line with the Greening Government Commitments. |

People and structure

Our People and Culture Strategy

The People and Culture Strategy is a five-year culture change programme and is a critical part of our Corporate Strategy. The three strategic objectives in the strategy will deliver outcomes against organisation and people, leadership, and culture. Together, these outcomes will deliver sustainable and positive change for TPR and support the organisation in adapting and responding to the changing landscape of pension regulation.

We are working to build the detailed architecture of the programme, define the high-level implementation plan and the estimated cost and resource to deliver year 1 and beyond.

Equality, diversity, and inclusion

During 2021, we introduced our EDI Strategy and recruited an EDI lead to take forward the EDI action plan. Our internal approach to being a diverse, fair and inclusive employer focuses on the following:

- capability – providing training, toolkits, guidance and support packages that give employees, managers and senior leadership the skills and knowledge they need to identify, assess and address EDI risks within TPR

- capacity – making EDI part of everyone’s role so it is part of day-to-day business

Through addressing our capability and capacity, we aim to create a thriving workplace where the members of our team have a voice, feel they belong and are valued for what they bring to TPR. We will support our team with a collaborative environment, access to shared resource and support for learning and development opportunities.

Structure and resource allocation

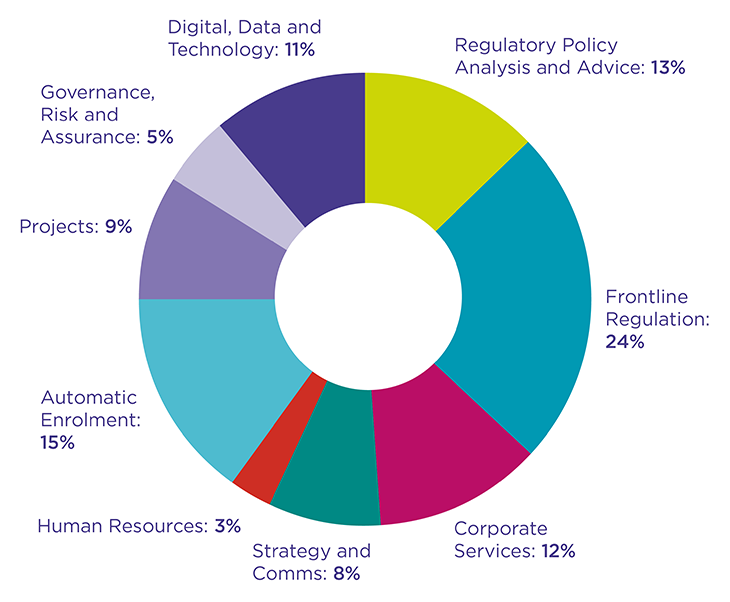

We expect our resources to be allocated across the organisation in 2022 to 2023 as follows. Figure 2 below shows how the total number of TPR staff are split across different directorates. This is depicted as: 13% in Regulatory Policy, 24% in Frontline Regulation 12% in Corporate Services, 8% in Strategy and Communications, 3% in HR, 15% in Automatic Enrolment, 9% in Projects, 5% in Governance, Risk and Assurance and 11% in Digital Data and Technology.

Figure 2: Resource allocation

Financial summary

Funding

Our funding is derived from two main sources: a grant-in-aid from the DWP, which is recoverable from a scheme levy relating to Pensions Act 2004 duties, and a separate grant-in-aid from general taxation relating to the AE programme arising from Pensions Act 2008 duties.

The funding agreed for 2022 to 2023 is £111.5 million, a decrease of £0.4 million compared to the 2021 to 2022 budget.

2022 to 2023 budget

The total 2022 to 2023 budget of £111.5 is a decrease of £0.4 million against the 2021 to 2022 budget, a £5.5m increase for levy and a £5.9 million decrease for AE. We are committed to achieving efficiency savings of 5% over the Corporate Plan period.

The levy increase is due to increased spend on specific initiatives such as superfunds supervision, collective defined contribution and climate change, increased spend on digital activities, higher project spend and planned expenditure to deliver the Accommodation Strategy.

The AE decrease is due to the lower operating costs since the majority of services were insourced and lower project spending following the completion of the AE transformation project.

| £Ms | 2021 to 2022 budget | 2022 to 2023 budget |

|---|---|---|

| Levy |

65.3 |

70.8 |

| Automatic enrolment |

46.6 | 40.7 |

| Total |

111.9 |

111.5 |

We will continue to support and work with the DWP in its review of the Pensions General Levy.

Average payroll staff numbers

The 2021 to 2022 actual and 2022 to 2023 budget average payroll FTE staff numbers are shown below. We have planned a small growth moving in 2022 to 2023 mainly to support the delivery of our portfolio and other specific initiatives and the growth in AE reflect a full year of the new insourced delivery model.

| 2021 to 2022 (actual) | 2022 to 2023 (budget) | |

|---|---|---|

| Levy |

552 |

588 |

| Automatic enrolment |

273 |

298 |

| Total | 825 |

886 |