The Pensions Regulator’s (TPR) strategy establishes our commitment to put the pension saver at the heart of our work. It sets a stretching ambition for the future, detailing our aspirations for all workplace pension savers and the role we will play in achieving them.

Published: 10 March 2021

Chairman’s introduction: Our changing world

The security and value that pensions provide for millions of savers feels more important today than ever before.

The coronavirus pandemic has shown us just how much things can change in a short space of time. How this crisis shapes our future is difficult to predict, but its impact will be long lasting and deeply felt.

In my seven years at The Pensions Regulator, change has been the one constant in the world around us: from technological innovation, to means of communication, to the way we work and live our lives. Across all of this, climate change, the key challenge of our times, is driving comprehensive social, economic, and political change.

The pensions landscape is moving just as quickly. Pensions freedoms, authorised master trusts, and the Pension Schemes Act 2021, which introduces pensions dashboards, collective defined contribution schemes, and greater powers for TPR to secure saver outcomes, are all driving significant change for us, the marketplace, and for savers.

This comes on top of an already fundamental shift: more than 10 million new savers, many of whom would not have previously had access to pensions, are now saving for retirement through automatic enrolment.

This shift to DC saving has transformed and diversified the pension saver population. It underlines the importance of our work and of the central purpose of this strategy: putting the saver at the heart of all we do.

Different groups of pension saver face distinct challenges in meeting their needs today and making provision for tomorrow. To put the saver at the heart of our work, our strategy-setting process has been grounded in an analysis of pension savers: their needs, the challenges they face, and how the changing landscape may shape their financial futures.

Our five strategic priorities and commitment to savers were determined in response to this analysis. They seek to ensure that all savers’ pensions are enhanced and protected now and in the future.

We have tested our thinking through a phase of external engagement. A broad range of stakeholders and interested parties took the time to explore in detail our analysis of savers and the landscape and our provisional strategic choices. I am hugely grateful for the quality of insight provided by all who engaged with us and for the depth of scrutiny this process has brought.

Our statutory objectives give us the remit and foundations for this strategy. As we look to the future, we expect our strategy will evolve as the world around us and the world of pensions continues to evolve. Whatever the future holds, TPR exists to make workplace pensions work for savers. Building on our new operating model and clear, quick and tough approach, this strategy sets out how we will meet the challenges of the future and put the pension saver at the heart of all that we do. I look forward to seeing it come to life.

Mark Boyle, Chairman

CEO’s introduction: Our purpose

At the end of our fifteenth year, and in a changing world, it is timely to look ahead and consider how we must evolve if we are to continue to serve the interests of all pension savers. We have looked forward to what we think the next 15 years may bring to set this ambitious strategy for our evolution.

Millions of savers rely on pensions to replace income in later life. Pensions occupy a unique position among long-term savings options. These are the only savings that cannot be accessed before the age of 55 and are enhanced through tax relief and employer contributions. For many, a workplace pension, alongside the state pension, will be the only money they have to live on in retirement.

The pensions landscape has transformed since TPR was established in 2005, the same year the Turner Pensions Commission published proposals that led to an extension of workplace savings – through automatic enrolment – which has driven this transformation.

Less than 10 years ago, workplace pension saving was for the minority. Pensions were mostly held in defined benefit (DB) schemes, which promise the saver a set retirement income. These savers rely on us to ensure their schemes are funded to meet these promises and we have therefore taken a scheme-based view to this work.

Today, most DB schemes are closed to new members. The 10 million automatically enrolled savers are mostly saving into defined contribution (DC) schemes, as will new savers that follow.

DC savers are in a very different position: their pensions do not come with promised retirement incomes. These savers rely upon the value they get for their money while they accumulate their pension savings. Our role is to drive the value and security that will determine the quality of their financial futures.

Our focus must evolve from a scheme-based view to one that puts the saver at the heart of all that we do. Workplace pensions offer unique benefits and we will drive participation in pensions saving.

Savers who are building their pension pots can expect us to enhance the quality of their savings outcomes.

Savers that have built up pension pots and are in or approaching retirement can expect us to protect the money that they have spent years saving.

This will not be an overnight change for us. There is still much to do to secure the outcomes of savers in DB schemes, both open and closed. Equally, as the DC system evolves, we must ensure that it delivers good quality outcomes. We will therefore need to carefully balance our focus, acting where we can make the most difference – and for the benefit of all savers.

We will take a system-wide view, making sure that savers can join well-run schemes, that money goes into pensions when it should, that it is well looked after and delivers value, and that savers can make good decisions and are protected when it comes to taking their money out.

We set clear expectations, act quickly where these are not met, and are tough where we need to be.

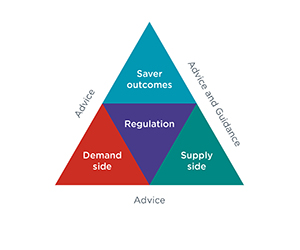

We are not alone in pursuing good outcomes for savers. We are committed to working with our partners in regulation at the Financial Conduct Authority, the Prudential Regulation Authority and the Money and Pensions Service, as well as with government and industry.

Our work is guided by the Better Regulation framework and the Regulators’ Code. Building on this platform, we will be bold innovators of our regulatory approach and work to reduce friction in the system and make compliance easier. As we evolve, we will continue to use our expertise in pensions regulation to sustain our authoritative, independent voice on how the system is working.

I am extremely proud of our hugely talented and committed team who will implement this ambitious strategy. The drive and expertise of our people underpins all that we achieve. As we look to the future, we will prioritise attracting, retaining and developing the best people for the task ahead. In doing so, we can be confident that we will fulfil our ambitions for the savers we exist to serve.

Charles Counsell, Chief Executive

Our statutory objectives

Our mandate derives from statutory objectives, which are set out in the Pensions Act 2004, amended by the Pensions Acts 2008 and 2014. These are:

- to protect the benefits of members of occupational schemes

- to promote, and to improve understanding of, the good administration of work-based pension schemes

- to protect the benefits of members of personal pension schemes where direct payment arrangements are in place

- to reduce the risk of situations arising which may lead to compensation being payable from the Pension Protection Fund (PPF)

- in relation to DB scheme funding, to minimise any adverse impact on the sustainable growth of an employer

- to maximise employer compliance with employer duties and the employment safeguards introduced by the Pensions Act 2008

Our strategy guides us in meeting these statutory objectives and delivering on our commitment to pension savers.

Our responsibilities intersect with those of other regulators. Where pension savers’ outcomes are affected by issues beyond the scope of our current powers we will, where appropriate, support and collaborate with others on these issues, playing our part within a coherent regulatory system.

Pension savers and how they will evolve

To put pensions savers at the heart of all that we do, we first need to understand the saver – the different circumstances they face, as well the pensions landscape before them.

We exist to enhance and protect the outcomes of all pension savers. To do this, we must recognise points of commonality and points of difference. For example, we have used data and insight from a broad range of sources to analyse the challenges that younger and older savers may face over the next 15 years, so we can tailor our approaches to the needs of different savers.

Our analysis also considers the different factors that influence savers’ retirement outcomes. We can think about these factors from many perspectives: automatically enrolled savers, for example, bring their own challenges in terms of engagement, understanding their projected outcomes and, for those who frequently change jobs, the accumulation of multiple small pots. For all savers, working patterns and places of employment are significant, as are their lifestyles and domestic circumstances.

We recognise the links between protected characteristics – such as gender, ethnicity, disability and age – and pension savers’ outcomes: for example, that gender and ethnic minority pay gaps and lower rates of employment manifest in worse outcomes for many individuals within these groups; that employment rates and average pay among people with disabilities in turn affect retirement savings outcomes.

We also recognise that some vulnerable savers have particular needs and may be less able to represent their own interests than other savers. The circumstances and needs of vulnerable savers are wide ranging and liable to be driven or further affected by heath matters and life events. The effects of the coronavirus pandemic, for example, will exacerbate the circumstances of many vulnerable savers, as well as putting more savers into vulnerable positions.

Alongside all of these factors there has been a significant and structural shift in the pensions landscape, which has impacted savers differently. The change from a largely DB landscape to one where the vast majority of savers are in DC schemes can be most clearly shown by looking at savers in terms of their age and income. Those with the greatest reliance on DB savings (especially outside of public service schemes) are mainly older savers with higher incomes. Those with a heavier reliance on DC pensions are predominantly younger savers that have been automatically enrolled into DC master trusts.

The implications of this shift in the pensions landscape is of such significance that we set out our indicative analysis of savers in this section with reference to age and income. The relationship between age, income and retirement savings is represented in this cohort graphic which, drawing on available data, presents a simplified estimation of the relative reliance that different generations and income groups are likely to place on DB, DC, the state pension (SP), and other long-term savings (LTS).

Savers’ relative reliance on retirement wealth sources

See note on methodology used for graphic

Baby Boomers

Over the coming 15 years, the Baby Boomer generation will complete their move into retirement. While some Baby Boomers have never held a workplace pension, this generation has historically saved into pensions more than later generations, most commonly through DB schemes.

Higher-income Baby Boomers will rely on DB pensions more than any other group.

|

Baby Boomers |

||

|---|---|---|

| High - middle income |

|

|

| Middle - low income |

|

|

| Low - very low income |

|

|

Key risks and opportunities

Baby Boomers have far more exposure to DB than other generations of saver. Sponsors of DB schemes have experienced long-standing economic volatility and, in the wake of coronavirus, we expect financial strain and uncertainty to continue. Many DB schemes are not currently funded to meet the promises on which the Baby Boomers rely (the majority of DB schemes are currently in deficit). Our new Defined Benefit Funding Code of Practice will provide greater clarity around funding standards, setting out our expectations of trustees and employers.

We know from the Money and Pensions Service that many Baby Boomers do not feel financially capable. Many will be facing care costs and the challenges of a complex retirement market and lack of transparency around their pensions. This hinders decision-making among this group, who are the most likely to fall victim to pension mis-selling and scams.

Our core challenge for these savers, who have built up pension pots and are in or approaching retirement, is to protect their savings

Key areas of focus will include:

- security and value in DB pension schemes

- working with our partners to prevent and tackle pension scams, and

- enabling good saver decision-making

We have determined these areas of focus in line with our statutory objectives to protect the benefits of pension savers, to reduce the risk of compensation being payable from the PPF, and to minimise any adverse impact on the sustainable growth of an employer.

Generation X

While many higher-income Generation X savers will be in DB schemes, the proportion of DB savers among this cohort is lower than it is for high-middle income Baby Boomers. A high proportion of high-middle income Generation X savers are in DC schemes – most commonly single employer schemes or master trusts run by large, established providers.

Many middle-to-low and low-to-very-low income Generation X savers have been automatically enrolled into master trusts and are saving into a pension for the first time. Most will be making the minimum statutory contributions and have relatively limited time in which to build up their pension pots.

Automatically enrolled Generation X savers may be unaware that a few years of statutory minimum contributions will not, by themselves, meet their financial needs in retirement. Added to this, our research shows us that many of these savers have given little or no thought to how they will manage financially in retirement.

|

Generation X |

||

|---|---|---|

| High - middle income |

|

|

| Middle - low income |

|

|

| Low - very low income |

|

|

Key risks and opportunities

Research shows us that higher-income Generation X savers generally feel financially resilient and confident about managing their money. However, this group has higher levels of unsecured debt than other groups of savers. Many within this ‘sandwich generation’ will reach retirement supporting both their children and their parents, in addition to facing their own care costs.

Automatically enrolled Generation X savers are generally less likely to engage with their pensions than Baby Boomers. A factor behind low engagement may be the lack of transparency and perceived complexity of pensions. For these savers, with small pension pots unlikely to meet their full income needs in retirement, the efficiency and value of the pensions system will be a key determinant of their financial futures. Their savings risk erosion from poor or unsuitable investments, high costs and charges, and low-quality services which are further impeded by data issues.

Generation X savers would benefit from market innovations and regulatory developments that drive greater transparency and simplicity, for example through improved data quality and the simplification of benefits statements and decumulation products.

Millennials

Millennials exemplify savers’ changing needs. They will earn their money differently to other generations, working more flexibly and seeking flexible saving solutions to match.

We expect the growth in multiple short-term employments, zero hours contracts and ‘gig economy’ work will be concentrated particularly among lower-income Millennials.

Automatic enrolment is having a significant impact on Millennials and most will at some point start pension saving as a result. However, these savers will typically make the statutory minimum level of contributions and their more erratic employment patterns and varied contract types could make ongoing pension saving a challenge.

Higher-income Millennial savers generally feel financially resilient and are already saving for their long-term futures. While some of these savers will be in DB (principally public service) schemes, most will have DC pensions. As with Generation X savers, the value in the pensions system will be a key determinant of their financial futures.

|

Millennials |

||

|---|---|---|

| High - middle income |

|

|

| Middle - low income |

|

|

| Low - very low income |

|

|

Key risks and opportunities

Many Millennials have no savings. Our research also shows us that the majority feel they don’t know enough about pensions to make suitable choices.

Millennials will increasingly concentrate into large master trusts as consolidation takes effect.

This brings the opportunity for enhanced savings outcomes where schemes are well run, offer access to a range of investments, and bring economies of scale. Consolidation can however amplify systemic risk, for instance in relation to cyber security, and could possibly suppress market competition were a handful of schemes to dominate.

Given the amount of time Millennials have left to accumulate their pensions, these savers are most likely to be impacted by risks associated with the proliferation of small pots, where they move from job to job over their working lifetimes.

Advances in technology should improve the quality and security of data. While investment and increased compliance will increase costs in the shorter-term, technology can make administration more efficient and lower costs in the longer-term. We also expect dashboards and fintech to increase transparency and reduce the cost and effort of making decisions.

Our core challenge for Millennial and Generation X savers, who are building their pension pots, is to enhance the value that pensions provide so that their savings provide a good return when they come to retire

Key areas of focus will include:

- driving participation in workplace pensions

- ensuring that savers get value from their pensions and that their money is secure, and

- encouraging and supporting innovation

We have determined these areas of focus in line with our statutory objectives to maximise employer compliance with automatic enrolment and to promote and improve understanding of the good administration of pension schemes.

Generation Z

Over the course of this strategy, a new generation will have entered the employment market – Generation Z. These savers will have their own blend of needs and challenges and live and work in a markedly different world compared with the savers who are currently entering retirement.

Some Generation Z savers have already commenced their working lives. Those that are pension saving will most commonly have been automatically enrolled into DC schemes and, like Millennials, will rely on the system providing good value for money. We are committed to investing in analysis and insight to understand the needs of Generation Z savers as they emerge. Building on this understanding, we will continue to evolve to meet these new savers’ needs and in readiness for the generations that follow.

The pensions landscape and how it will evolve

The scale and pace of the changes we have seen in the pensions landscape show no sign of slowing down. As we look forward to the coming 15 years, our analysis suggests we will be regulating fewer but larger schemes of all types as the market consolidates: for occupational DC this could be around 50% fewer schemes and for DB around a third fewer.

These larger schemes come with their own risks and yet will become systemically important to UK financial stability. Given their size and importance, our regulatory approach will need to be highly integrated with other regulators.

The roll-out of automatic enrolment, which began in 2012, has driven a seismic increase in the number of workplace pension savers. These new savers have predominantly been enrolled into DC trusts and today there are more than 15 times as many active savers accumulating in DC schemes than are accumulating in DB schemes. Nonetheless, more than one million people are still contributing into a private DB pension and the volume of assets required to fully guarantee DB promises (for all savers) is currently more than five times higher than projected DC assets and is likely to remain higher throughout the 15 years covered by this strategy.

Balancing the current and future needs of millions of newly enrolled DC savers with the responsibility of ensuring the assets backing DB pension promises are secured is the central challenge we face.

Workplace pensions active savers

See note on methodology used for graphic

DB obligations / DC assets

Key trends in the pension landscape

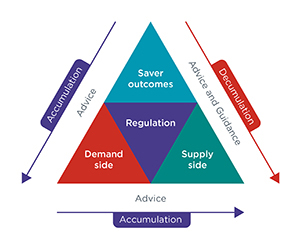

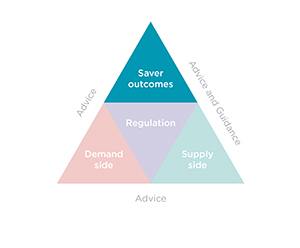

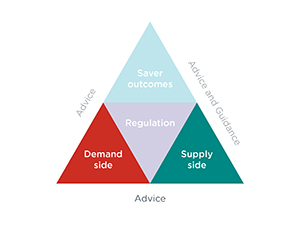

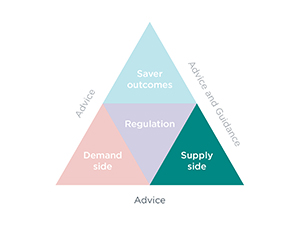

We anticipate substantial continuing evolution of the broader pensions landscape. Our analysis highlighted a set of eight overarching trends that will shape the future of retirement saving. We are using this market map to aid our thinking on the landscape. By considering which part(s) of the market are most affected by a trend, we can then think through the implications for other parts of the market and the leverage we have in helping to shape or respond to that trend in the interests of savers. For each of the trends below we have highlighted the relevant part(s) of the market.

The nature of work and retirement is changing

While traditional employment models will continue, many people will work and earn money differently. This ongoing change to the way we work has quickened in the

wake of coronavirus. Many people are starting to save later in life and we expect a growing number will work part-time in retirement to supplement their income while they can. The market will respond to these changes and how people save for the long term will continue to evolve.

The balance of the marketplace is shifting

We expect a shift in the trustee model, with fewer, more professionalised trustees who are increasingly appointed by providers rather than employers/members. We also anticipate employers will continue to evolve benefits packages to meet employees’ changing needs and working patterns. The shift away from promised benefits means that the quality of outcomes will increasingly be determined not only by the decisions trustees make, but also by the decisions made by employers, providers and others in the system. In DC pensions especially, employer choices could come to dominate the ‘demand’ side of the market. It is important for us to monitor the market if we are to protect and enhance savers’ outcomes in the face of this change. This includes understanding the impact of decisions made by employers and provider-employed trustees on saver outcomes and how the market for employer advice is working.

The proportion of DB memberships and assets continues to reduce

For all but a few sizeable (principally public service) schemes, DB schemes will be closed to new members and as they mature will become increasingly focused on matching their liabilities. For closed schemes, a priority will be to address any funding gaps and ensure there are clear plans in place to meet the promises made to members. We expect the economic impact of coronavirus will quicken consolidation and anticipate that the market will innovate and develop alternatives to traditional DB schemes.

The DC market is growing and consolidating

DC consolidation provides the opportunity for enhancing saver outcomes through better governance, administration and value. It is important that we closely monitor the market as it develops and use data and intelligence to drive a differentiated approach to our supervisory work, ensuring we remain focused on those schemes which pose the biggest risk to saver outcomes.

Suppliers will innovate and integrate

We anticipate that some providers will expand to operate across the full supply chain, offering advice, products and services. Some will offer a wider range of products,

including decumulation and alternative long-term savings products. We will need to keep pace with innovations and develop effective regulatory responses, collaborating with the market and other regulators where appropriate.

The demand for stewardship of investments will grow

As trustees increasingly professionalise, global threats such as climate change and cybercrime will drive demands on these trustees for effective governance and responsible, ethical asset management. These threats will also help shape our own evolution. Savers and policy-makers will expect that trustee decision-making is both diverse and inclusive in its quest for good pension outcomes, as well as connecting more closely with corporate governance and sustainability considerations. This will drive a growing focus on the effective stewardship of investments as a means of delivering sustainable benefits, not only for savers but for the economy, the environment and society.

Technology will drive and enable change

The pensions system is overdue a technology-driven change and the pensions dashboard may be a catalyst for accelerating the pace of this change. While investment in new technology may not be prioritised during financially difficult times, we expect some in the market will innovate in response to the challenges that savers and the system now face. Advances in technology should drive transparency and increase the quality of data, bringing improvements in administration and member communications while lowering costs. However, we are also mindful of the risks that innovation can sometimes bring, for example where fintech may enable hasty decisions. It is important we embrace the changes brought about by technology, for ourselves and the way we operate and for the market in general. We expect to work closely with industry in driving and embedding technology, sharing good practice, and ensuring strong associated governance.

Regulatory frameworks will evolve

The evolution of the marketplace and wider landscape demands a holistic and integrated regulatory approach. In light of consolidation, the demand for stewardship, and market innovation and integration, we anticipate further evolution of regulatory frameworks. We also expect the pace of this change may quicken in the wake of coronavirus. Other environmental factors will also have the effect of shaping the market, as current initiatives relating to climate change are already doing. These factors in turn have implications for our own evolution and the way we regulate.

Our strategic priorities

Workplace pensions offer unique benefits and we will drive participation in pension saving.

Pension savers need us to understand their needs and challenges. They need us to be alert to changes in the landscape and proactive in helping to shape those changes in their interests. They need us to respond promptly and decisively to risks and opportunities so that we drive better outcomes.

Our strategy sets us up to enhance and protect the retirement outcomes of all pension savers. This means that, as savers go through the pensions system, their money works well for them and is protected along the way.

Our commitment to pension savers

We are putting the pension saver at the heart of all that we do.

Savers who are building their pension pots can expect us to enhance the quality of their savings outcomes.

Savers that have built up pension pots and are in or approaching retirement can expect us to protect the money that they have saved.

Strategic priorities

We have set five strategic priorities, each with a strategic goal:

Security

Strategic goal: Savers’ money is secure

Our primary goal is to protect the money that savers invest in pensions. We will work to ensure that DB schemes are funded to meet the promises made to savers and that, where necessary, savers can continue to rely on the security provided by the Pension Protection Fund. We will drive consolidation where this is in savers’ interests and better protects their money. We expect the payment of contributions into schemes to be prompt and accurate and we will intervene quickly where this does not happen. We will work with our partners to protect savers from scammers and to tackle cyber-enabled risks. As assets in DC schemes grow over the 15-year horizon of this strategy, ensuring the security of savings in these schemes will also be a key focus.

Value for money

Strategic goal: Savers get good value for their money

Pension savers are entitled to expect good value for their money. This means that savers’ money must be suitably invested, costs and charges must be reasonable, and good quality, efficient services and administration are driven by robust data. We will work with our regulatory partners and industry to establish common standards on value for money, setting clear expectations and sharing good practice. We will actively pursue value for money throughout the pensions system and intervene where our expectations are not met. Where consolidation occurs, we expect it to deliver improvements in the value of savers’ outcomes.

Scrutiny of decision-making

Strategic goal: Decisions made on behalf of savers are in their best interests

Savers’ outcomes are greatly influenced by the decisions that others make on their behalf. We will monitor those who make these decisions, across all scheme types, scrutinising any that pose a heightened risk to the quality of outcomes. We will increase our focus on managing savers’ exposure to economic risks, including environmental, social, and governance risks. We expect decisions that affect savers to be fair and transparent and will encourage diversity among those who take decisions on behalf of savers. Where we believe poor decisions may lead to bad outcomes for savers, we will intervene. We will explore issues relating to the decisions employers make on behalf of savers, including the selection of pension products and the support they feel able to offer to assist savers’ decision-making. Our work will also continue with other regulators and providers to improve savers’ access to helpful information, guidance and, where appropriate, advice.

Embracing innovation

Strategic goal: The market innovates to meet savers’ needs

The market should meet and keep pace with savers’ needs. We will encourage innovation, facilitating the development of technology and sharing of good practice, and collaborating with the market to encourage security, efficiency, transparency, simplicity and choice. Our focus on innovation includes emerging scheme models: we will work with the market on the development of DB alternatives to ‘traditional’ schemes as well as on the development of decumulation products in DC trusts and the establishment of Collective Defined Contribution schemes. We expect extensive, continuing change in the pensions marketplace and as we evolve we will balance our resources to intervene where we can have the greatest impact on saver outcomes.

Bold and effective regulation

Strategic goal: TPR is a bold and effective regulator

We will transform the way we regulate to put the saver at the heart of our work, driving participation in pensions saving and focusing on the value and security that pensions provide. We will remain a key part of a coherent regulatory system, working closely with others and taking opportunities to align regulation and minimise burden, adopting a principles-based approach where this is appropriate. We will identify and share good practice, setting clear expectations for those we regulate. Where our expectations are not met, we will act quickly and be tough where we need to be. Our approach will be proportionate to the challenges we face, and we will demonstrate our own effectiveness and value. Throughout our evolution we will maintain a sharp focus on bold and innovative regulation, anticipating and preventing issues before they materialise. We will continue to adapt to a changing world, flexing our approach to the opportunities and constraints of the time, working with our partners and industry to deliver on our commitment to pension savers.