This is an official statistics publication produced by The Pensions Regulator (TPR). This annual publication provides an overview of funding levels and recovery plans in occupational defined benefit (DB) and hybrid pension schemes in the UK. Additional data for calculations and a complete glossary of terms are available in the annex of the report.

Published: 4 September 2025

Introduction

This publication is based on tranche 18 schemes, with effective valuation dates from 22 September 2022 through 21 September 2023, inclusive.

Schemes typically submit funding data to us every three years. This means tranche 18 belongs in the same cohort of schemes as tranches 15, 12, 9, 6 and 3.

By July 2025, we received 1,640 valuations with an effective valuation date covered by tranche 18; 72% of these schemes had submitted valuations in all previous funding cycles.

Important changes since last year

In this publication, the assumptions used to calculate the Single Effective Discount Rate (SEDR), a single composite rate that approximates the maturity profile of schemes, have been updated to reflect both refined actuarial modelling and recent shifts in the economic environment. The revised assumptions incorporate updated estimates of the duration of benefit payments for different member groups, most notably, shorter durations for active and pensioner members, based on the latest modelling. These changes aim to better reflect the expected timing of future benefit payments and align with current actuarial advice. In parallel, the SEDR parameters have also been influenced by significant movements in UK interest rates since our last publication. While such parameters are routinely reviewed and adjusted in line with market conditions, the changes observed over the year from 22 September 2022 have been more pronounced than usual, reflecting broader economic developments and shifts in market expectations that emerged during the latter part of 2022. The SEDR parameter updates apply only to tranche 18 and beyond, and comparisons with previous years should be made with care, taking account of the evolving assumptions and economic backdrop.

There have also been some improvements made to our data and production processes which have had a small impact across the annex tables of this publication. All changes to values in the annex tables are smaller than 3 percentage points. All changes have been applied to the current and all historic tranches. When comparing with historic tranches you should use the most recent publication to ensure you are comparing a consistent methodology.

Key findings

- 62% of schemes reported a surplus position in tranche 18. This compares with 27% in tranche 15.

- The average (mean) assets to TP liabilities ratio for schemes in tranche 18 was 104% (median: 103%).

- The average (mean) recovery plan length for schemes in deficit was 4.4 years (median: 3.8 years), with a median end date falling in 2027. For comparison, the average (mean) recovery plan length in tranche 15 was 6.3 years (median: 5.3 years).

Funding levels

Overall, 62% of schemes reported a surplus on the TP funding basis in tranche 18, compared with 27% in tranche 15.

The average (mean) assets to TP liabilities ratio was 104% in tranche 18 (median: 103%), compared with 89% in tranche 15 (median: 90%), representing a 15 percentage point increase between funding cycles.

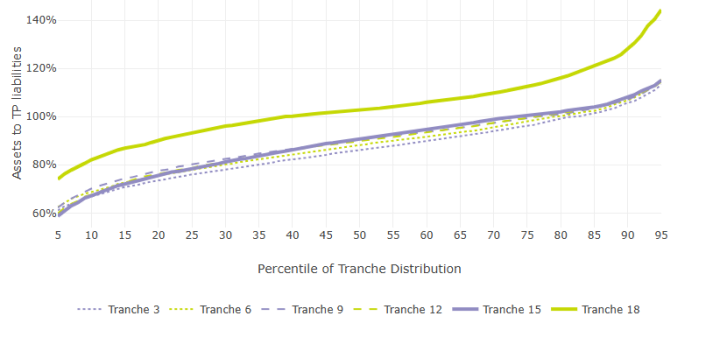

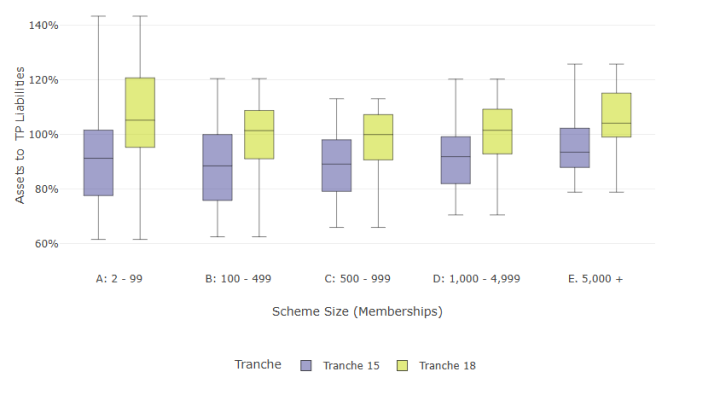

Funding levels have improved in the current tranche compared with tranche 15 across all scheme size categories (Figure 1). The largest median assets to TP liabilities ratio are seen in both the largest schemes (with more than 5,000+ members each) and smallest schemes (with less than 100 members each).

Figure 1: Assets to TP liabilities ratio by scheme membership size (tranche 15 and tranche 18, all schemes)

Distributions are constrained at the 5th and 95th percentiles

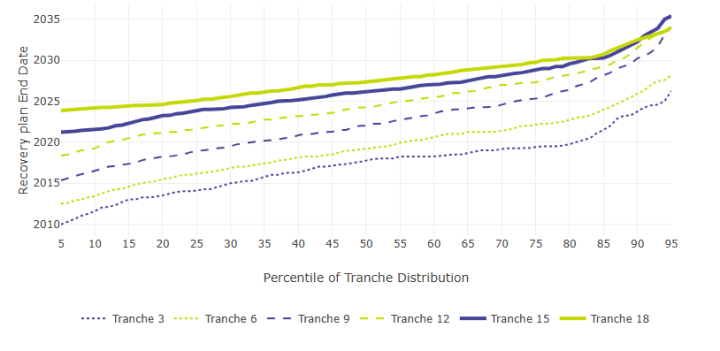

Tranche 18 shows a substantial improvement in the assets to TP liabilities ratio compared with previous tranches. Since tranche 3, which covered valuations between 22 September 2007 and 21 September 2008, the average assets to TP liabilities ratios have substantially improved, going from 81.2% to 103.6% in tranche 18, a 22.4 percentage point increase (Figure 2; annex Table 2.1a).

Figure 2: Assets to TP liabilities ratio (all schemes, all relevant tranches)

Distributions are trimmed at the 5th and 95th percentiles

Recovery plans

Schemes that have a funding deficit at the effective date of their actuarial valuation are required to prepare a recovery plan to achieve full funding in relation to TP liabilities. In tranche 18, 38% of schemes were required to submit a recovery plan, compared with 73% in tranche 15.

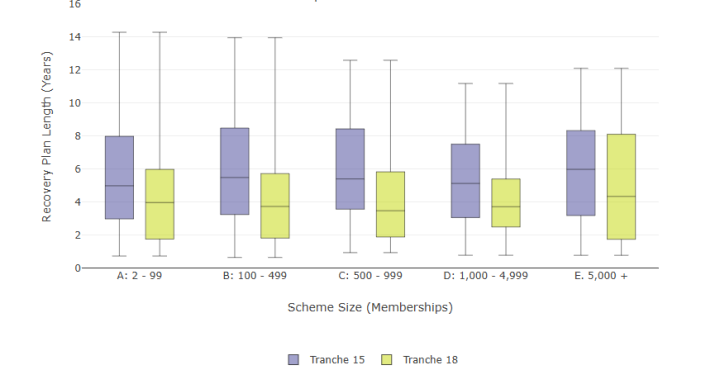

The average recovery plan length in tranche 18 was 4.4 years (median: 3.8 years). The equivalent recovery plan length in tranche 15 was 6.3 years (median: 5.3 years). The reduction in average recovery plan length from tranche 15 to tranche 18 was 1.9 years (median: 1.5 years). The equivalent reduction in average recovery plan length from tranche 12 to tranche 15 was 1.1 years (median: 1.3 years).

Recovery plan lengths were shorter in the current tranche compared to tranche 15 in all membership categories (See details in figure 3).

Figure 3: Distribution of recovery plan length by scheme membership size and tranche (tranche 18 and tranche 15 schemes in deficit)

Distributions are constrained at the 5th and 95th percentiles

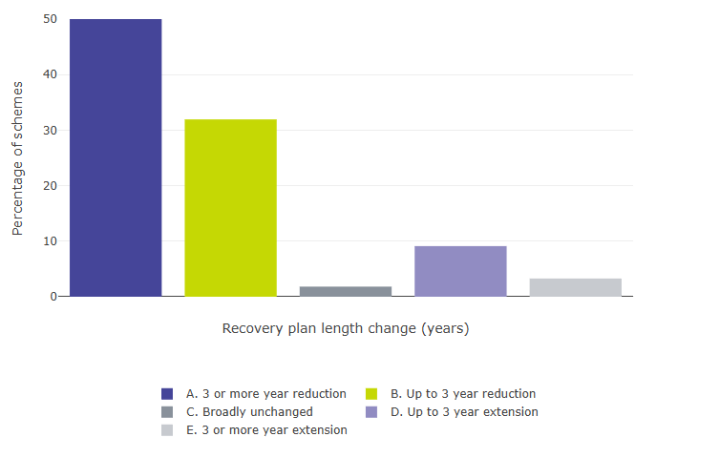

Within the subset of schemes in deficit in both tranches, 86% reported reductions in their recovery plan length between tranche 15 and tranche 18 (See details in figure 4).

Considering the three-year inter-valuation period, a reduction in recovery plan length of more than three years between tranches means bringing forward the date at which the scheme is anticipated to be fully funded. Between tranche 15 and tranche 18, 54% of schemes (that were in deficit at both valuations) saw the end date of their Recovery Plan brought forward in this way.

Figure 4: Changes in recovery plan length between tranche 15 and 18 (representing 550 schemes which were in deficit in both tranches)

In tranche 18, the median recovery plan end date is anticipated to fall in 2027, compared with 2026 in tranche 15. These end dates reflect the combination of recovery plan lengths and valuation dates, and provide a complementary view to the analysis of recovery plan durations.

580 schemes (45%) which were required to submit a recovery plan in tranche 15 were no longer required to do so under tranche 18 (Figure 5).

Figure 5: Distribution of recovery plan end dates (schemes in deficit, all tranches)

Distributions are trimmed at the 5th and 95th percentiles

Using this publication

Data sources

The data contained in this statistical release was submitted by schemes to The Pensions Regulator (TPR) in triennial valuation summaries, their associated recovery plans, and annual scheme returns. The dataset builds on previous releases and includes tranche 18 valuations and associated recovery plans received up to July 2025. 1,640 occupational DB and hybrid schemes have submitted valuations to TPR in tranche 18.

Tranche 18 is the third tranche of the sixth cycle of the Scheme Funding Regime, generally reflecting the sixth valuation of this cohort of schemes. Tranche 18 has due dates for submission to TPR between December 2023 to December 2024. None of the valuations in this publication are subject to the new funding and investment strategy requirements which only apply to valuations with an effective date on or after 22 September 2024.

Table 1.1 details which tranche of schemes belong in which funding cycle. Tranche 18 belongs in the same cohort as tranches 15, 12, 9, 6 and 3. However, these cohorts do not contain exactly the same schemes. Reasons for this difference include schemes:

- carrying out valuations more frequently than every three years

- submitting the results of the valuation to TPR late

- that are wound up or in the process of winding up

- that are new (for example as a result of reorganisations, mergers, buyouts or transferring all members to a new scheme)

- that have transferred to the Pension Protection Fund (PPF)

Considering the three-year valuation cycle, schemes typically submitting valuations in tranche 18 would have submitted their previous valuation in tranche 15. This means in most cases, tranche 15 data is the most appropriate comparison with the latest tranche.

Assets, liabilities and deficits/surpluses in this bulletin are defined on a TP basis. Where a scheme is sectionalised or segregated each section is treated as if it were a separate scheme for this report. The dataset counts each segregated section of assets and liabilities as a separate scheme for the purpose of these funding statistics. Therefore, each ‘scheme’ in this data may represent a pension scheme with a single section, or a segregated section within a sectionalised pension scheme. The remainder of this publication uses ‘scheme’ as shorthand for ‘scheme or segregated section’.

The data presented in this report is as submitted by the scheme, and not rolled forward to a common date.

The dataset counts all memberships in schemes with a promise to a pension. As some individuals may have a number of pension entitlements spread over a number of schemes, they may be included more than once in the total memberships under consideration.

The summaries on mortality assumptions are based on current male pensioners aged 65 only, unless otherwise stated.

The latest figures on DB scheme membership along with rolled forward asset and liability positions can be found in our occupational DB landscape publication: Occupational defined benefit landscape in the UK 2024.

Methodology

These statistics report on administrative data and actuarial calculations derived from it. Accuracy of administration data is addressed by eliminating data errors as far as possible. Potential sources of error include the following:

- schemes entering data incorrectly as part of their valuations

- data processing while creating structured datasets from the scheme valuations input and any manual corrections as part of that process

- mistakes in the programming code used to analyse the data and produce the statistics, and by analysts interpreting the data incorrectly

Further, the figures shown here are the results of actuarial calculations. These are based on assumptions for schemes’ future experience. In practice, the cost of providing benefits within these schemes will vary according to the schemes’ actual future experience, not the assumptions made. This experience inevitably will not be exactly in line with the assumptions made.

Throughout this publication we have rounded percentage figures to zero decimal places and recovery plan lengths to one decimal place. Numbers of schemes have been rounded to the nearest 10. Percentages and years are rounded to one decimal place. Mortality rates are the exception, which are rounded to whole numbers. Discount rates and outperformance measures are rounded to three decimal places. Scheme counts and number of members are not rounded. Figure totals and percentages may not sum to expected values due to rounding.

Weighted averages are weighted by TP liabilities. Where ‘average’ is used in the report, it refers to the mean.

Owing to the scheme-specific nature of the data, individual data points cannot be presented. As such, data distributions start and end at the 5th and 95th percentiles respectively, and in some instances group ranges have been broadened to include figures comprising fewer than 10 observations.

Where schemes have made updates to submissions on historic tranches, these updates are included in this publication. For this reason, you should always use the current publication to access statistics for historic tranches rather than referring to previous publications.

The discount rate assumption is reported to TPR by schemes in one of two formats:

- a single investment return

- different investment returns for pre-retirement and post-retirement benefits

For the purposes of comparison, in instances where different rates have been reported, a single effective discount rate (SEDR) is calculated. This is based on the single rate or, where a different rates approach has been adopted, constructed from both the pre- and post-retirement rates. The SEDR is calculated as the weighted average of the pre-retirement discount rates and post-retirement discount rates where the weights are based on the pre and post-retirement durations and the value of Technical Provisions for active, deferred and pensioner members respectively.

The duration parameters used in the above method are estimated on a scheme-by-scheme basis, using data provided to us in the annual scheme return and valuation returns. Using the above method the SEDR has been calculated for all schemes (schemes in deficit only for tranches 1–7; all schemes for tranches 8–18), and as the duration parameters have changed for tranche 18, historical positions will differ to earlier publications.

The outperformance of the SEDR is calculated using gilt yields that reflect the average duration of liabilities. For tranche 18, 15-year gilts (nominal and real) are used to reflect a shorter average duration, whereas previous tranches continue to use 20-year gilts. As a result, the levels of outperformance assumed may differ from those shown in previous reports.

Average annual deficit reduction contributions (DRCs) summarised in Table 3.4 are calculated as the average of DRCs over the first four years of the recovery plan.

Covenant Groups (1–4) are assigned at the point of initial recovery plan reviews to facilitate prioritisation. These grades may vary to the view taken during case-level intervention, where a wider range of information is taken into account. They are defined as:

- Covenant Group 1: Strong

- Covenant Group 2: Tending to strong

- Covenant Group 3: Tending to weak

- Covenant Group 4: Weak

Covenant assessments are not usually undertaken for schemes in surplus.

Contact

Glossary

00 series base mortality table (00 series)

Based on 1999-2002 experience collected from UK insurance companies.

92 series base mortality table (92 series)

Based on 1991-1994 experience collected from UK insurance companies.

Actuarial valuation

A comparison by the actuary of the value placed on scheme assets with the TP liabilities and an assessment of any future contribution requirement. Calculation of the TP liabilities is usually based on full member-by-member data.

Buyout liabilities (or s75 or solvency)

This refers to the scheme actuary’s estimate of the cost of securing scheme liabilities with annuities purchased from a regulated insurance company, which may be used as the solvency estimate as part of the actuarial valuation for a scheme in windup. Section 75 (s75) of the Pensions Act 1995 provides for the calculation of a debt on the employer on the buyout basis (s75 debt) if a scheme winds up (or if an employer becomes insolvent or ceases to participate in a multi-employer scheme). Throughout this publication the term ‘buyout’ is used. In a small number of cases, an alternative measure of solvency is submitted to us, in which case this will be the data that has been used in this analysis and there is no distinction made.

Contingent assets

Contingent assets are assets on which a claim by the pension scheme would exist on the occurrence of one or more specified future events (‘the contingent event’), such as movements in corporate asset holdings, increased employer borrowing, employer failure or the failure to achieve a specified funding level. Unless the events occur, these assets are not available to the trustees to meet members’ benefit payments. They are not included as scheme assets for the purpose of assessing whether a scheme meets its statutory funding objective (i.e. that assets are sufficient to cover TP liabilities) until they are transferred to the scheme.

Continuous Mortality Investigation (CMI)

The CMI Mortality Projections, created by the UK Actuarial Profession, are based on a deterministic model driven by user inputs. The model is based on the assumption that current rates of mortality improvement converge to a single long-term rate. CMI_2021, was published in March 2022, CMI_2022 was published in June 2023 and CMI_2023 was published in April 2024.

Deficit reduction contributions (DRCs)

These are contributions made by sponsors to the scheme in order to address any asset to TP liabilities deficit, in line with the Schedule of Contributions and the recovery plan.

Defined benefit (DB)

A pensions scheme for which benefits are worked out using a formula that is usually related to the members’ pensionable earnings and/ or length of service. These schemes are also referred to as ‘final salary’ or ‘career average salary’ pension schemes.

Hybrid scheme

A pensions scheme that provides a combination of defined benefit and defined contribution benefits, either in separate sections or from built-in features that make sure members get at least a minimum promise, as well as any investment value.

Different rates

Where separate discount rates are reported in respect of pre-retirement and post-retirement benefits in the valuation of liabilities. (See also ‘Single rates’).

Discount rate

A discount rate is a rate of compound interest which is used to calculate the present value of a sum due at a later time. This action discounts the sum due to its value today. It inherently assumes that the present value is invested and has to earn the chosen discount rate to achieve the sum due at the later time. (See also ‘Single rates’, ‘Different rates’).

Effective date (valuation date)

An actuarial valuation or an actuarial report considers the funding of a scheme as at a particular date, known as the effective date. The effective date will be earlier than the date on which calculations are done. The effective date of a scheme’s first Part 3 valuation cannot be before 22 September 2005.

Part 3 valuation or scheme funding valuation

An actuarial valuation meeting the requirements of Part 3 of the Pensions Act 2004 concerning the funding of DB pension liabilities, which apply to any actuarial valuation received by trustees (on or after 30 December 2005) that is based on an effective date of 22 September 2005 or later.

Pension Protection Fund (PPF)

A corporate body established under the Pensions Act 2004. The PPF was set up to provide compensation to members of eligible DB pension schemes, when there is a qualifying insolvency event in relation to the employer, and where there are insufficient assets in the pension scheme to cover the PPF level of compensation.

Pension protection levy

This is the annual amount that a pension scheme is charged by the PPF. It is composed of a scheme-based levy and a risk-based levy.

Recovery plan (RP)

Under Part 3 of the Pensions Act 2004, where there is a funding shortfall at the effective date of the actuarial valuation, the trustees must prepare a plan to achieve full funding in relation to the TP liabilities. The plan to address this shortfall is known as a recovery plan.

Recovery plan length

The recovery plan length is the time that it is assumed it will take for a scheme to eliminate any shortfall at the effective date of the actuarial valuation, so that by the end of the recovery plan it will be fully funded in relation to the TP liabilities.

Scheme

In this publication, ‘scheme’ refers to a segregated section of assets and liabilities. This may represent a pension scheme with a single section, or a segregated section within a sectionalised pension scheme.

Self-Administered Pension Schemes (SAPS) base mortality tables (includes ‘S1’, ‘S2’ ‘S3’ and ‘S4’ series)

Based on mortality experience of UK self-administered pension schemes. In October 2008, the CMI published the ‘S1’ Series; the first mortality tables to be based on UK pension scheme data. The S2 Series was issued in February 2014, the S3 Series was issued in December 2018 and the S4 Series was issued in February 2024.

Section 179 liabilities (s179)

This refers to a valuation of a scheme’s funding level relative to the PPF compensation which would be payable to its members if they transferred to PPF. See section 179 of the Pensions Act 2004. This measure is designed to be a close approximation to the liability measure that would be used to decide whether the PPF would need to take on the scheme were the employer to become insolvent. In contrast to TP liabilities, the assumptions to be used in an s179 valuation are prescribed by the PPF and are standard across all schemes. They are designed such that s179 is close to the cost of securing the valued benefits with an insurance company at the valuation date.

Section 179 (s179) valuation

To calculate the risk-based pension protection levy, the PPF board must take account of scheme underfunding. To obtain a consistent basis for determining underfunding, schemes must complete a PPF valuation (section 179). This valuation will be based on the level of assets and liabilities for the scheme. The liabilities will be based on the scheme benefits, taking into account key features of the levels of compensation paid by the board of the PPF, as set out in Schedule 7 of the Pensions Act 2004.

Short (SC), medium (MC) and long (LC) cohort projections

A number of UK mortality studies have shown that the birth cohort of pensioners born around 1926 is, on average, living longer than those born earlier or later (the ‘golden cohort’). In 2002, the UK Actuarial Profession created three different cohort projections which take account of the ‘golden cohort’ effect, each projecting the future of the ‘golden cohort’ differently. The ‘short cohort’ projections assumed that the ‘extra’ improvement in longevity experienced by the golden cohort will last, for the most fortunate generation, until 2010 (before reverting to ‘normal’ levels of improvement), the ‘medium cohort’ projections assumed the effect will last until 2020 and the ‘long cohort’ projections assume the effect will last until 2040.

Note: Short and Medium Cohort projections have not been used since tranche 10.

Single effective discount rate (SEDR)

A single composite discount rate and made up of constituents of the different discount rates reported, allowing approximately for the maturity of schemes. This approach is also used to normalise bases where the discount rate varies year-on-year. Please see the ‘Methodology’ section of this document for greater detail.

Single rates

Where a single discount rate has been reported in respect of the valuation of pre-retirement and post-retirement liabilities.

Technical provisions liabilities (TP liabilities)

The funding measure used for the purposes of Part 3 valuations (see above). The ‘TP liabilities’ are a calculation undertaken by the actuary of the assets needed at any particular time to make provision for benefits already considered accrued under the scheme using assumptions prudently chosen by the trustees - in other words, what is required for the scheme to meet the statutory funding objective. These include pensions in payment (including those payable to survivors of former members) and benefits accrued by other members and beneficiaries, which will become payable in the future.

Tranches

‘Tranche’ refers to the set of schemes which are required to carry out a scheme-specific funding valuation within a particular time period. Schemes whose valuation dates fell from 22 September 2005 to 21 September 2006 (both dates inclusive) were in tranche 1, from 22 September 2006 to 21 September 2007 were tranche 2 (both dates inclusive) and so on. Because scheme-specific funding valuations are generally required every three years, schemes whose valuations are in tranche 1 will also be likely to carry out valuations in tranches 4, 7, 10, 13 and 16.

Triennial valuation cycles (cycles)

Given that all schemes are required to submit a Part 3 valuation to TPR at least every three years, each three-year period (three valuation tranches), is referred to as a cycle. Cycle 1 corresponds to the first three valuation tranches (tranches 1, 2 and 3); Cycle 2 the second three valuation tranches (tranches 4, 5 and 6) and so on. The majority of Cycle 2 plans (tranches 4, 5 and 6) are second valuations under the scheme funding regime. However, tranches 1 and 4 (2 and 5, and so on) do not constitute a perfect cohort. See the ‘Data coverage’ section in this document for further detail.

Valuation summary

A form to be completed when a recovery plan and schedule of contributions have been agreed by the trustees and the employer, following an actuarial valuation.