The response to our draft DB funding code of practice consultation that explains our twin track regulatory approach to assessing valuations and the proposed design of Fast Track.

Published: 29 July 2024

Introduction

Overview

We held our consultation on Fast Track and our regulatory approach from 16 December 2022 to 23 March 2023, as part of a comprehensive consultation package on DB funding including the first draft defined benefit (DB) funding code of practice.

We’re publishing this Fast Track and regulatory approach consultation response alongside the final draft DB funding code, which has been laid in parliament, and the consultation response to our first draft code. We recommend reading the documents together.

The new long-term planning requirements introduced in the Pension Schemes Act 2021 and Occupational Pension Schemes (Funding and Investment Strategy and Amendment) Regulations 2024 (the regulations) came into force on 6 April 2024. The new requirements will start to apply to scheme valuations with effective dates on or after 22 September 2024.

The final draft code provides clear guidance and expectations on how to comply with the new funding requirements. Fast Track will act as a regulatory filter for how we assess actuarial valuations. Where a scheme meets a series of Fast Track parameters, we will ask for less information and are less likely to engage with trustees based on the scheme valuation submission.

In this document, we outline the feedback we received on our proposed Fast Track parameters and twin track regulatory approach, and set out how we have finalised our position. We have included a summary of responses to the consultation and the final Fast Track parameters, as well as a Fast Track behaviour analysis assessment.

We have finalised our Fast Track parameters to reflect the significant change in market conditions, our approach in the final draft code, and responses to our consultation.

Our Fast Track behaviour analysis assessment shows that improvements in schemes’ funding positions between March 2021 and March 2023 means that more schemes can meet our Fast Track parameters. We estimate that as at March 2023 62% of schemes meet all the parameters and a further 19% could change their funding approach at no extra cost and meet all the parameters.

We will publish these final Fast Track parameters separately as a standalone document when the final draft code comes into force. We will also communicate more about our regulatory approach in due course, which will include more detail on the Fast Track and Bespoke submission routes.

There is overlap between this consultation and our statement of strategy consultation. We are carefully considering responses to this consultation as we finalise our approach to the statement of strategy, which sits outside of the final draft code.

Consultation responses

Thank you to everyone who responded to this consultation and provided feedback directly to us throughout this process. This feedback has been critical to ensure that our regulatory approach and the specific Fast Track parameters are fit for purpose and embed existing good practice.

There was support for our proposed approach to Fast Track, which had evolved to address concerns raised in responses to our first consultation on our twin track regulatory approach in 2020. Respondents provided useful feedback on our general approach and the parameters, which we have carefully considered.

Summary of responses

In this section, we set out the key themes raised in the consultation and our responses. Overall, our proposals were broadly welcomed and therefore we have made only limited changes. This excludes a review and revision of parameters allowing for the change to the definition of significant maturity and market conditions.

You can read a summary of consultation responses by question in our summary of consultation responses. We also set out our approach to Fast Track, including our twin track regulatory approach, updated Fast Track tests and conditions, detail on how to use the small scheme proxy to project future duration, and the basis underlying our Fast Track parameters.

Response to our positioning of Fast Track

There was strong support for our proposed approach to Fast Track and its positioning, relative to the first draft code. It was noted that our approach addressed concerns raised in responses to a previous consultation on potential loss of flexibility for scheme-specific approaches as a result of the twin track approach, with concerns that Bespoke was viewed as second best with increased evidential burden.

We were clear in our 2022 consultation that Fast Track is our regulatory filter for our assessment of valuations and won’t be used as a benchmark for our assessment of Bespoke funding approaches. In the consultation we proposed that, where a scheme meets a series of Fast Track parameters, trustees can expect to provide less information in the statement of strategy. These parameters represent our view of tolerated risk for a scheme where we are unlikely to engage on the valuation. However, we were clear Fast Track is not risk-free, won’t be right for every scheme and does not equal compliance. Trustees must also follow the legislation and consider the code principles.

Respondents reiterated the importance of clear messaging on the general twin track framework. Some respondents wanted more detail, including when Fast Track might not be appropriate, and the role of covenant in Fast Track. We believe that, as schemes must follow legislation and should follow the principles of the code, there is already enough information for schemes to determine if their funding and investment strategy is appropriate. Additionally, as the approach to the funding and investment strategy should be scheme specific, a limited number of hypothetical examples are unlikely to be helpful to most schemes. However, we will consider this further as we develop our communications.

There was also support for us having the flexibility to update Fast Track in the future, although respondents highlighted the need for a clear review policy to ensure stability in funding plans.

Less information and evidence provided in Fast Track

There was strong support for Fast Track requiring less information and explanation as part of the valuation submission, although respondents urged that any additional burden for schemes submitting a Bespoke valuation should be kept to a minimum, with the level of detail provided based on the level and complexity of the risk being taken. This is being finalised as part of our statement of strategy consultation.

Actuary confirmation

We had proposed that the scheme actuary confirms the submission meets the Fast Track parameters. While there was no significant challenge to our actuarial confirmation proposal, clear conditions were suggested by respondents to limit unintended consequences, and manage risks of increased compliance costs and practical and liability implications. We will engage further as we develop the actuary’s confirmation approach to ensure we carefully consider concerns and potential impacts.

Response to our Fast Track parameters

There was broad support for our approach to our Fast Track parameters, with recognition in responses that we are responsible for deciding where we set our regulatory filter, as those wanting to take a more scheme specific approach could follow the Bespoke approach.

Technical provisions

There was overwhelming support for our approach for setting Fast Track technical provisions (TPs) as a percentage of the low dependency funding basis liabilities. It was thought to be a sensible and pragmatic approach which was simple, easy to apply and communicate.

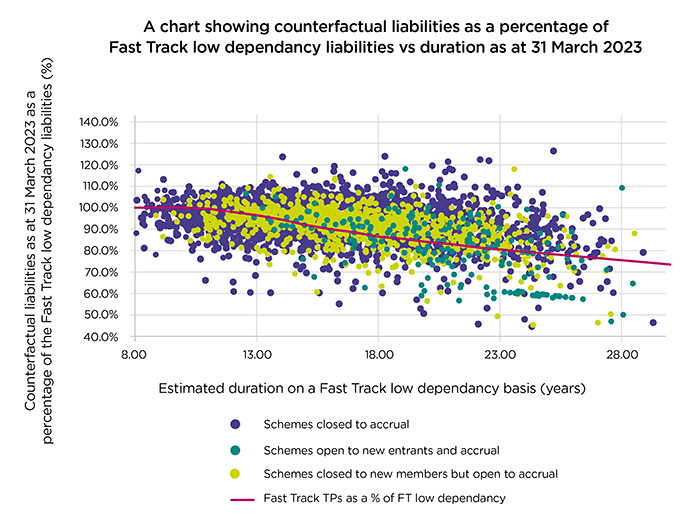

Respondents did suggest the limits proposed should be reconsidered due to the change in market conditions. We have considered movements in market conditions up to 31 March 2023 to derive the parameters published in this document. In particular, we have taken into account changes in expectations of future returns and adjusted the TPs discount rate to Gilts + 1.75% pa (from the previous Gilts + 2.0% pa) at the immature end of the curve. There has been no change to the low dependency discount rate of Gilts + 0.5% pa.

Low dependency

There was support for our approach to the discount rate and other assumptions in the low dependency funding basis, although some sought more clarity on how to approach the expense reserve and commutation factors. Respondents agreed with the proposed flexibility for smaller schemes.

Significant maturity

Respondents to our consultation package on DB funding did not support a different parameter for significant maturity in Fast Track relative to the code. Therefore, and to maintain simplicity of approach, we have aligned Fast Track to a significant maturity point of 10 years as set out in the final draft code.

Recovery plan

The majority agreed with our proposed approach to set the maximum recovery plan length after significant maturity to three years in Fast Track. Our approach to using the effective valuation date as the starting point for the recovery plan length was acknowledged for providing consistency and removing the incentive to delay completing the valuation, although some recognised it can take 12 months or more to complete the valuation. Our approach to post-valuation experience was largely supported.

While our approach to CPI indexation was widely supported, following feedback we have revised our approach to give more flexibility in Fast Track to allow for different patterns of payments in recovery plans, and give the additional option of fixed increases of deficit repair contributions (DRCs) (at 3% pa) as well as CPI increases.

Stress test

A significant majority agreed with our approach to the stress test, and supported the simple approach we adopted. Our approach to schemes in surplus was also supported. Some asked for greater clarity on the investment allocation used in the test, and we have added some additional wording to make this clearer. Some respondents raised issues with the simple approach, including that the test can be gamed. When raising issues, some noted that addressing the issue would reduce the simplicity of the test. Therefore, we have not made any changes, to maintain the simple nature of the test and not increase the burden on schemes.

A significant majority agreed with our proposal to use PPF tier 1 asset classes. Following feedback, we have not included a prescription as to how the Tier 2 asset classes should be mapped to the Tier 1 asset breakdown.

Smaller schemes

Most respondents agreed with our approach to allowing smaller schemes to use a proxy to calculate future duration rather than producing cashflows. While most agreed with our definition, some wanted to extend the definition by increasing the number of members or using a definition that mixed assets and liabilities with membership numbers. Following further consultation on the statement of strategy, we have extended the definition of a small scheme to those with 200 members or fewer. This excludes members who are eligible for lump sum death benefits only, for hybrid schemes, members with DC benefits only, and fully insured annuitants where they are not included in the calculation of the TPs liabilities.

Future accrual

There was support for our approach to taking account of new members and future accrual when determining future maturity. The majority also agreed with the assumed period for new entrants and/or future accrual being set at six years. However, noting that the final draft code approach has been updated to reflect further flexibility in this area, in Fast Track we have extended this period from six years to nine years. This means that more open schemes will potentially comply with Fast Track than if the period was set at six years.

Our approach

Our twin track regulatory approach

This section sets out our regulatory approach at a high level. We will publish further detail in due course. In this section, references to code should be understood to mean the final draft code.

We are adopting a twin track approach to assessing DB scheme valuations. There will be two valuation submission routes, Bespoke and Fast Track.

Both Bespoke and Fast Track are equally valid. Following either of these approaches does not automatically equate to compliance, and we expect the legislative and code principles to be followed.

Where the code sets out our expectations for compliance with the legislation, Fast Track provides more direction and clarity on our view of a level of risk that we will tolerate.

The Fast Track approach will act as a filter for our assessment of actuarial valuations that are submitted to us. If a valuation submission meets a series of Fast Track parameters, we are unlikely to scrutinise it further and it is less likely that we will engage with trustees.

The Bespoke approach allows trustees to have the flexibility to select scheme-specific funding solutions if the funding approach and actuarial valuation meet legislative requirements and follow code principles.

Trustees must submit a certain amount of quantitative and qualitative information to us in a statement of strategy. Details regarding the level of data to be provided will be set out separately to this document.

Bespoke

Bespoke offers trustees flexibility and scope to select an approach that suits the specific circumstances of their scheme. Bespoke submissions are principle-based but with clear boundaries based on the legislative requirements and the expectations set out in our code.

Bespoke valuation submissions are available for all schemes if legislation and key code principles are followed. While this list is not exhaustive, trustees may submit a Bespoke submission if they:

- want to take more risk than available under Fast Track and can demonstrate that the total risk run by the scheme is supportable by the employer covenant and in line with the maturity of the scheme

- cannot meet all of the Fast Track parameters, including the Fast Track recovery plan parameters due to employer affordability constraints

- have unique employer circumstances that necessitate a different approach

Fast Track

Fast Track is not risk-free. Fast Track is a regulatory tool which represents our view of tolerated risk where we are unlikely to engage with a scheme in respect of the valuation. It does not represent minimum compliance. In some instances, the Fast Track parameters are set above the minimum level of compliance, whilst in other instances, adopting Fast Track may not be the appropriate route.

Trustees should think carefully about whether Fast Track is right for their scheme and, in order to meet legislative compliance, whether a more prudent funding and investment approach is appropriate, particularly where there is very limited employer covenant support. Our code covers the arrangements we would expect trustees to follow in these circumstances.

If a scheme meets all the Fast Track parameters, we are unlikely to scrutinise the valuation submission further.

There is one set of Fast Track parameters for TPs, investments and recovery plans, all set by reference to the maturity of the scheme.

The Fast Track parameters cover:

- the low dependency funding basis

- TPs

- funding and investment risk

- recovery plans

Employer covenant

While our Fast Track parameters do not vary in respect of employer covenant metrics, trustees still need to ensure that Fast Track is appropriate for their scheme, given the strength of the employer covenant that can support the funding and investment risks.

Employer covenant support is recognised explicitly in legislation as a key element for assessing supportable risk. Our code provides clear expectations for how we expect trustees to assess covenant.

Scheme actuary confirmation

One of the criteria for Fast Track is that the scheme actuary must confirm the submission meets the Fast Track parameters.

This will require the actuary to confirm that the tests and conditions described in this document and summarised in Appendix 1 are met. These are factual matters and the actuary is not being asked to confirm as to whether, in their opinion, Fast Track is appropriate or the legislation and principles in the code are being complied with.

We will include further details around the expectations of the scheme actuary in further communications and we will engage with industry as we finalise our approach.

If the actuary is not able to provide that confirmation, the valuation submission will need to be Bespoke.

The requirement for a scheme actuary to provide this confirmation gives us additional reassurance that the requirements of Fast Track are met and therefore that, generally, we should not have to engage with schemes following a Fast Track valuation submission.

Smaller schemes

We have allowed some simplification of our requirements for smaller schemes using Fast Track. In particular, the underlying calculations in respect of the scheme liabilities can be undertaken by using a spot rate rather than a full yield curve methodology.

For these purposes, we have defined smaller schemes as those with 200 members or fewer and excluding:

- members who are eligible for lump sum death benefits only

- for hybrid schemes, members with defined contribution (DC) benefits only

- fully insured annuitants where they are not included in the calculation of the TPs liabilities

This approach will be consistent with our requirements regarding the definitions to apply regarding information to be supplied for the statement of strategy. This is subject to our reviews and does not override any other reporting statutory requirements.

Full details of these simplifications are shown in Appendix 1.

In addition, smaller schemes can use a simplified approach when undertaking the requirements for determining how the duration will change over time, which impacts on the date the scheme will reach significant maturity and the relevant date. The projected duration can be estimated using a specified proxy.

Full details of these simplifications are shown in Appendix 2.

Reviewing our parameters

As Fast Track is a regulatory approach based on our tolerated level of risk, we do not expect these parameters to change often.

However, as a minimum, we will review these annually to determine whether changes in market conditions or other changes in the universe of DB schemes’ funding levels and/or the economic environment employers face would justify revising the parameters. In circumstances where economic and market conditions have changed significantly in any intervening period, we may also do an extraordinary review of the parameters and assumptions.

Furthermore, we will undertake a comprehensive review of all the Fast Track parameters and the assumptions underlying them every three years. The three-year period is in line with schemes’ triennial valuations. When we do this review, we will look at the method and assumptions underlying the parameters, as well as the parameters themselves. We will carry out a consultation on any changes to the method and assumptions used to set the Fast Track parameters.

Details in respect of how we derived our Fast Track parameters can be found in Appendix 3.

Appendix 1: Fast Track submission tests and conditions

In this appendix, references to code should be understood to mean final draft code.

Fast Track parameters

The following sections set out the tests and conditions a scheme must satisfy to meet the Fast Track parameters.

Smaller schemes

Some simplifications are allowed for in the calculations for smaller schemes. These are shown in the relevant sections.

In this context, a smaller scheme is defined as one with 200 members or fewer. This figure should exclude members who are eligible for lump sum death benefits only, for hybrid schemes, members with DC benefits only, and fully insured annuitants where they are not included in the calculation of the TPs liabilities.

Use of yield curves

For Fast Track compliance, it is a condition that the discount rate and inflation assumptions should use the yield curve approach except for smaller schemes, as defined above.

For Fast Track compliance, the discount rate should be based on the gilt yield curve. The Bank of England publishes suitable gilt yield curves daily. In this context, the gilt yield reflects the full yield curve extrapolated appropriately.

For those smaller schemes, a spot rate may be used as a proxy for the yield curve. The discount rate and inflation assumption should be based on the Bank of England’s annualised spot gilt yield at a duration nearest to that of the scheme’s duration.

Fast Track submissions

A scheme that passes all the tests and meets all the conditions may submit a Fast Track valuation.

We would expect trustees doing so to have considered the legislative requirements and principles in the code and satisfied themselves that their funding and investment strategy complies with those principles.

While we note that there are exemptions for specific schemes in the code whose significant maturity is lower than duration 10, for example cash balance schemes, for Fast Track purposes we are applying the same parameters to all schemes. For schemes that do not meet all our Fast Track parameters, including those with exemptions regarding the date of significant maturity lower than duration 10, they will need to submit a Bespoke valuation.

Duration

Duration is calculated using the accrued liabilities and a basis consistent with the scheme’s low dependency funding basis assumptions but derived using market conditions as at 31 March 2023, as set out in the regulations. For Fast Track, the economic assumptions at each valuation must be based on the economic conditions that applied at 31 March 2023, as if that were the valuation date.

For open schemes, the calculation of duration can use accrued liabilities and an allowance for future service.

For Fast Track, the allowance for future service can be no more than nine years of accrual, based on existing membership and benefit structure for schemes that are closed to new entrants. For schemes that are open to new entrants, the assumed number of new entrants to the scheme should not exceed the average level of new entrants over the three years preceding the current valuation.

Where appropriate, the trustees should choose a shorter period of future accrual or lower level of assumed new entrants to comply with the general principles in the code.

For the funding and investment stress calculation, the duration used in that specific calculation must be consistent with the duration used to determine whether a scheme meets that Fast Track parameter.

Fast Track – Technical provisions

For a scheme to meet the Fast Track parameters, the scheme’s TPs must be at least a minimum level. For the avoidance of doubt this funding level should be calculated excluding DC-only benefits.

This minimum level is determined as a percentage of the scheme’s liabilities calculated on the low dependency funding basis. This minimum percentage varies by the duration of the scheme.

The minimum percentage is shown in Table 1 below.

Table 1: Fast Track TPs test parameters

| Duration | Minimum technical provisions (%) |

|---|---|

| 25 | 78.0% |

| 24 | 79.0% |

| 23 | 80.0% |

| 22 | 81.0% |

| 21 | 82.0% |

| 20 | 83.5% |

| 19 | 85.0% |

| 18 | 86.5% |

| 17 | 88.0% |

| 16 | 90.0% |

| 15 | 92.0% |

| 14 | 94.0% |

| 13 | 96.0% |

| 12 | 98.0% |

| 11 | 99.0% |

| 10 | 100.0% |

Where the duration is not an integer value, the parameters from this table should be interpolated.

For schemes with duration greater than 25, the parameter should be extended by a further deduction of 1.0% for every duration year beyond duration 25.

The Fast Track low dependency liabilities are the low dependency liabilities calculated on the minimum Fast Track low dependency basis described later in this appendix. Trustees may choose to use more prudent assumptions than these in their scheme’s low dependency basis.

Where this is the case, and the scheme does not meet the test based on the scheme’s own low dependency assumptions, the scheme actuary can carry out a further test using the Fast Track low dependency liabilities. If the TPs as a percentage of the Fast Track low dependency liabilities are greater than the parameter in Table 1 using the scheme’s duration, the scheme is Fast Track compliant.

For a Fast Track submission, the actuary will confirm the liabilities meet or exceed the minimum level based on the scheme’s own assumptions or the minimum assumptions required by Fast Track.

Fast Track – Funding and investment stress

For a scheme to meet the Fast Track parameters, it must demonstrate that, if fully funded and invested in its current notional investment allocation (defined below), when stressed, the scheme’s funding level would not fall by more than a set percentage. This is the Fast Track funding and investment stress test. The percentage fall in funding levels depend on the duration of the scheme and are set out in Table 2.

Table 2: Fast Track funding and investment stress test parameters

| Duration | Stress parameter |

|---|---|

| 25 | 15.9% |

| 24 | 15.4% |

| 23 | 14.8% |

| 22 | 14.3% |

| 21 | 13.7% |

| 20 | 13.1% |

| 19 | 12.5% |

| 18 | 12.0% |

| 17 | 11.4% |

| 16 | 10.8% |

| 15 | 10.2% |

| 14 | 6.5% |

| 13 | 5.4% |

| 12 | 4.4% |

| 11 | 3.3% |

| 10 | 2.2% |

Where the duration is not an integer value, the parameters from this table should be interpolated.

For schemes with duration greater than 25, the parameter should be extended by a further addition of 0.5% for every duration year beyond duration 25.

In this context, by stressed we mean the assets and liabilities are adjusted to allow for a scenario reflecting potentially adverse changes in market conditions using specified parameters we set out below.

The calculation to determine the change in funding level is as follows:

1 – Minimum (Fast Track TP Parameter,Stressed Funding Level)

/ Minimum (Fast Track TP Parameter,Unstressed Funding Level)

Each element of this calculation is explained below.

Unstressed funding level

This is calculated as follows:

Unstressed Funding Level = Assets/Low Dependency Liabilities

The assets of the scheme should be consistent with the audited accounts. However, the value of assets should exclude the value of any asset backed contribution (ABC) assets included in the accounts. If a scheme has the value of insured assets included in the accounts, the asset value used should be consistent with that used in the calculation of the liabilities.

Stressed funding level

The stressed funding level is as follows:

Stressed Funding Level = Stressed Assets/Stressed Low Dependency Liabilities

Stressed assets

To calculate the stressed assets you use, see the asset categories in Table 3 and apply the following stress factors.

Table 3: Asset categories and stress factors

| Asset categories | Stress factor |

|---|---|

| Fixed interest UK government bonds | +17% |

| Fixed interest investment grade bonds other than UK government bonds | +3% |

| Fixed interest sub-investment grade bonds | -6% |

| Inflation-linked UK government bonds | +16% |

| UK quoted equities | -16% |

| Overseas quoted equities | -16% |

| Unquoted equities / private equity | -19% |

| Property | -4% |

| Diversified growth funds | -10% |

| Annuities | +16% |

| Cash | +0% |

| Other | -19% |

The average stress factor weighted by asset category percentage must be calculated. This is known as the asset stress factor.

Stressed assets are then calculated as follows:

Stressed Assets = Assets X (1+ Asset Stress Factor)

The percentage of assets in each category should be derived from the current notional investment allocation. The current notional investment allocation is the investment strategy, which supports the current funding assumptions. For a scheme on or after the relevant date, given that the funding assumptions should be consistent with a low dependency funding basis, the current notional investment allocation will be the same as the low dependency investment allocation from which the low dependency funding basis set out in the funding and investment strategy is derived.

These percentages should be worked out excluding any ABCs.

Where a scheme includes insured assets, these should be treated consistently with the approach adopted for calculating the low dependency liabilities.

Where the statement of strategy covers different asset categories, or is in a different format, they should be allocated in line with the appropriate asset class in table 3, based on their underlying characteristics. Help text regarding asset categorisation for these purposes can be found on our website in relation to the scheme return: Asset breakdown).

Stressed liabilities

The calculation of the stressed liabilities uses the following parameters.

Table 4: Fast Track stressed liability parameters

| Liability stress factors | |

|---|---|

| Interest rate stress factor | -0.74% |

| Inflation stress factor | -0.11% |

The calculation of the stressed liabilities is as follows:

Stressed Low Dependency Liabilities

= Low Dependency Liabilities X ( 1

+ 0.74%) ^ (maximum (10,Duration at Valuation Date)) X (1

-0.11%) ^ (maximum (10,Duration at Valuation Date) X Inflation Liability Proportion)

The duration to be used should be consistent with the duration applied as to whether the scheme meets the test as set out in Table 2.

The inflation liability proportion is the proportion of the low dependency liabilities, which is sensitive to inflation.

Fast Track technical provisions parameter

This is the minimum parameter used to determine compliance with the TPs test, based on the duration of the scheme and taken from Table 1.

Overall

If the results of the calculation show a lower fall in funding level than the appropriate parameter derived from Table 2, the scheme is Fast Track compliant.

Where the scheme does not meet the test based on the scheme’s own low dependency assumptions, consistent with the TPs test, the scheme actuary can carry out a further test using the Fast Track low dependency liabilities. This test should use these liabilities and the duration calculated consistently with the Fast Track low dependency funding basis.

Fast Track: recovery plans

Where a recovery plan is needed, the following conditions must be satisfied to meet the Fast Track parameters.

Length of recovery plan

The recovery plan length must be no longer than:

(a) six years for a valuation where the valuation date is before the relevant date, irrespective of whether the relevant date occurs through the period of the recovery plan, and

(b) three years for a valuation where the valuation date is on or after the relevant date

The recovery plan length is measured from the effective date of the valuation.

Increases to deficit repair contributions (DRCs)

The annual increases to DRCs should not exceed, either:

(c) CPI inflation using the CPI inflation adopted by the scheme for the purpose of calculating the low dependency liabilities, or

(d) fixed increases at a rate of 3% pa

For trustees with irregular payment schedules, an alternative test is that the cumulative undiscounted DRCs to the end of each year of the recovery plan are no less than would have been paid under a recovery plan compliant with (a) and (b) above.

This provision only applies to contributions received after the date the recovery plan is certified for both tests.

The minimum level of DRCs as specified here exclude expenses and accrual or any other payment (or schedule of contributions), which should be allowed for separately.

No future outperformance in recovery plan and schedule of contributions

No allowance for future investment outperformance should be allowed for in the recovery plan (or schedule of contributions) for Fast Track compliance.

Post-valuation experience

Post-valuation experience can be taken into account in setting the recovery plan and for being Fast Track compliant. When done so, all significant changes, favourable as well as unfavourable, in the scheme’s assets, liabilities and covenant should be allowed for.

The trustees should report the date up to which post-valuation experience has been allowed and the updated assets and TPs used in the certification of the schedule of contributions. The TPs should also meet Fast Track parameters at the date to which post-valuation experience has been allowed.

Where post-valuation experience is allowed for in Fast Track, the certification of the schedule of contributions must be in the form as set out in Schedule 1 of The Occupational Pension Schemes (Scheme Funding) Regulations 2005.

Fast Track – Low dependency funding basis

The Fast Track low dependency funding basis needs to follow the principles set out in the code. In addition to these principles, certain assumptions are specified in Fast Track and assumptions at least as strong as these need to be used.

The Fast Track low dependency funding basis needs to calculated using the 'risk-free plus' approach, using the gilt yield curve for the risk-free element, extrapolated appropriately. The Bank of England is one organisation that publishes a set of suitable gilt yield curves daily.

All other approaches that are not consistent with this approach, for example the use of a swaps curve or the use of a dynamic discount rate approach, must be submitted through the Bespoke route.

The liabilities calculated on the minimum strength assumptions listed below are known as the Fast Track low dependency liabilities. This is the minimum value of low dependency liabilities that must be used when performing the tests as to whether a scheme meets the Fast Track parameters.

A summary of the code principles and the minimum Fast Track low dependency requirements that must be followed are shown below. These requirements apply to each assumption individually, rather than to the strength of the basis in aggregate.

Low dependency discount rate

Code principles and expectations

The discount rate could be expressed allowing for a margin over a risk-free yield.

An acceptable risk-free yield includes:

- the gilt yield, or

- the yield on swaps if adjusted for the probability of default

The margin added to the risk-free rate should be a prudent estimate of the return on the trustees’ low dependency investment allocation. This prudent estimate should have regard to material factors that may affect investment returns over the relevant time horizon, such as climate change and other systemic trends.

Minimum Fast Track low dependency requirements

The low dependency discount rate should be based on the gilt yield curve with an addition that should not be greater than 0.5%.

For schemes with less than 200 members, a spot rate may be used as a proxy for the yield curve. The gilt rate should be the Bank of England’s annualised spot gilt yield at a duration nearest to that of the scheme’s duration. The scheme’s duration is calculated at the date of the valuation using the low dependency liabilities, and determination of this discount rate could be an iterative process.

The discount rates can be rounded to one or more decimal places.

RPI inflation

Code principles and expectations

Under the risk-free plus approach, the RPI assumption should be based on a market-derived assumption for inflation using an approach consistent with that used for setting the discount rate.

For example, where a gilt yield curve is used to derive the discount rate, we would expect a yield curve approach based on gilts to be used to derive the inflation assumptions.

As the scheme is expected to be significantly hedged at the relevant date, our expectation is that no adjustment, such as an inflation risk premium, would be made to the market implied assumption. If an adjustment is made, we may require further information to understand the justification for it.

Minimum Fast Track low dependency requirements

The RPI assumption should be derived from the difference between index linked and nominal gilts.

No adjustment, such as an inflation risk premium, should be made to the market implied assumption.

For schemes with less than 200 members, a spot rate may be used as a proxy for the yield curve where the same approach is being used for the discount rate. The spot rate should be the Bank of England spot inflation assumption at the same duration used to derive the discount rate.

The inflation assumptions can be rounded to one or more decimal places.

CPI inflation

Code principles and expectations

The CPI assumption should be based on the RPI assumption, adjusted to reflect the expected difference between RPI and CPI, having regard to both historical trends and the planned changes in RPI expected to apply from 2030.

Minimum Fast Track low dependency requirements

The CPI assumption should be derived by reference to the RPI assumption adjusted as follows:

- Pre-February 2030 a maximum reduction of 0.8%

- February 2030 onwards no reduction

For schemes with 200 or fewer members, a spot rate may be used with CPI assumed equal to RPI. However, if all CPI-related increases are projected to be paid before 2030, a maximum deduction of 0.8% can be assumed.

Inflation-related pension increases

Code principles and expectations

The assumptions should be based on the relevant measure of inflation adjusted to allow for caps and floors based on a recognised method, such as, for example the Black or Black-Scholes, SABR, Jarrow-Yildirim, 'hard capping' or Truncated Gamma models, and an appropriate inflation volatility and other assumptions where required by the model.

In determining the appropriate assumptions, consideration should be given to past experience and whether this provides a guide to the future, given current market conditions, or how that experience should be adjusted to derive an appropriate assumption.

Minimum Fast Track low dependency requirements

As per code principles.

Cash commutation

Code principles and expectations

Members may be assumed to commute part of their retirement pension for a cash lump sum.

Where prudent, the proportion commuted should be no higher than recent experience and any projections should allow for any decreasing trend.

Also, where prudent, the assumed commutation factor should be no lower than currently agreed factors and/or, where appropriate, future factors where it has been agreed in principle they will be implemented. This will include market-based factors where it is agreed the factors will be automatically updated.

It can be appropriate to assume that a commutation factor is a percentage of the liabilities where such an assumption would be consistent with the previous principles.

When appropriate, consideration should be given to making an allowance for future improvements in mortality.

For example, where the trustees have the sole power to set cash commutation factors and those factors reflect the actuarial value of the pension commuted, we would expect an allowance for future improvements to factors to be made consistent with the trustees’ expectations for how mortality will improve in the future.

Minimum Fast Track low dependency requirements

As per code principles.

Mortality base table

Code principles and expectations

This is based on current expectations of mortality using appropriate mortality tools.

For example:

- a 'postcode' analysis and/or experience to adjust standard tables where recent credible information is available, or

- a bespoke mortality table based on experience

We expect many schemes will want to commission such analysis and would generally expect all trustees to have considered doing so. If this analysis is not done, standard tables may be used and consideration should be given to choosing a table reflecting the size of the pension where this might be appropriate as a guide to the socio-demographic status of the membership.

However, where such a standard approach is taken, we would expect the uncertainty of experience to be reflected in a more prudent set of rates being chosen.

Different groups of members can have different base mortality tables where there is evidence to justify their different treatment.

For example, those qualifying for an ill health pension might exhibit different mortality to those retiring with standard benefits.

Minimum Fast Track low dependency requirements

As per code principles.

Mortality improvements

Code principles and expectations

We expect appropriate assumptions for future mortality improvements should be chosen based on prudent principles allowing for the uncertain nature of future mortality improvements.

Consideration should be given to socio-economic factors specific to the scheme and how this should be reflected in the assumptions chosen.

Minimum Fast Track low dependency requirements

As per code principles, with the requirement that improvements need to adopt a recent CMI core or extended model, or equivalent model from an industry recognised reputable longevity company.

Salary increases

Code principles and expectations

The salary increase assumption can be a single rate or more complex, for example making allowance for promotional increases.

Where not constrained by the rules of the scheme or an established policy communicated to employees, we would expect salary increases to be at least as high as an appropriate inflation assumption.

Minimum Fast Track low dependency requirements

As per code principles.

Proportion with partners eligible for survivor pensions and age difference

Code principles and expectations

Where the scheme provides for survivor pensions, trustees should make appropriate allowance for the proportion entitled to survivor benefits and the age difference with the survivor.

When considering each assumption, where there is reliable and statistically credible scheme specific evidence available, we would expect the strength of assumptions chosen to be no lower than that implied by recent experience.

Where such evidence is not available, we would expect the assumptions to be:

- based on generic statistical tables, adjusted where necessary to allow for the scheme specific nature of the assumptions, and in the case of proportion married, for the rules of the scheme determining eligibility for survivor benefits, or

- be at least as strong as that provided by the PPF guidance on relevant assumptions to use in their section on assumptions for contingent benefits when undertaking a valuation in accordance with Section 179 of the Pensions Act 2004

Minimum Fast Track low dependency requirements

Scheme-specific evidence may be used as described in the principles in the code.

Where this is not available, the assumption chosen should be at least as strong as that consistent with PPF guidance for section 179 purposes.

Discretionary benefits

Code principles and expectations

Where there is a reasonable expectation that discretionary benefits will be granted in the long term, trustees should consider whether it is or is not appropriate to make reasonable allowance for these benefits in the low dependency funding basis and set an assumption accordingly.

Minimum Fast Track low dependency requirements

As per code principles.

Other assumptions

Code principles and expectations

There may be some assumptions needed as part of the valuation where we have not given our expectations in this section, for example retirement ages, withdrawal rate, or the allowance for scheme options other than cash commutation.

In setting assumptions where we have not given guidance, the following principles should be applied.

- Assumptions can draw on scheme experience where statistically credible analysis of recent experience is available, and the expectation is that the past remains a good guide to future experience.

- If this information is not available, standard tables or estimates may be used but the level of uncertainty in respect of scheme-specific factors should be reflected in additional prudence in the assumptions chosen.

- The impact on the liabilities can be considered when choosing assumptions, so for example a more approximate method would be reasonable where the choice of assumption will not significantly affect the liabilities.

- More generally, if it is an assumption not specific to the scheme and we have provided no guidance we would expect, where relevant, the derivation to be consistent with the derivation of other assumptions where guidance or specification has been provided.

Minimum Fast Track low dependency requirements

In line with the code principles, but with the additional requirement that scheme options, excluding those covered separately in this table like cash commutation, should only be allowed for to the extent they increase the liabilities in the low dependency funding basis.

Where it is prudent (for example for schemes who have chosen a salary increase assumption lower than an appropriate inflation assumption, because of the rules of the scheme or an established policy communicated to employees) the withdrawal assumption for liabilities should reflect the assumption for new entrants and future accrual used in the duration calculation for the TPs test. In these circumstances this means that accrual is capped at nine years and should be assumed members withdraw when accrual ceases.

Expenses

Code principles and expectations

That expense reserve should be the value of all non-investment related expenses of the scheme, including annual levies and adviser fees expected to be incurred on and after the relevant date discounted to the valuation date.

The expenses should be consistent with the long-term strategy adopted by the trustees. For example:

- if the strategy assumes the scheme will run on, it should be all the expenses associated with this

- for a scheme that is targeting buy-out, it should include the expenses associated with that strategy

Where at least one statutory employer has a legal obligation to meet part of the expenses, we expect the low dependency basis to include a reserve for at least the expenses not met by the employer.

For immature schemes, we recognise the expense reserve will be an approximate estimate. This estimate can reflect that the scheme may incur lower ongoing adviser fees once it achieves its long-term target funding and investment strategies and that the scheme may be smaller by the relevant date. As a scheme approaches its relevant date it should be possible to make that estimate more accurate.

For schemes at or past the relevant date, the expense reserve should be a more accurate estimate which we expect to be monitored and updated in line with experience.

Minimum Fast Track low dependency requirements

As per code principles. The exception to this, as set out in the code principles, applies in those cases, where there is at least one statutory employer with a legal obligation to pay scheme expenses.

For schemes with 200 or fewer members, expenses calculated using the expense assumptions consistent with PPF guidance for section 179 purposes can be considered suitable for these purposes.

Submission/confirmation by scheme actuary

Fast Track submissions should include a confirmation from the scheme actuary that the valuation meets Fast Track parameters.

To make a Fast Track submission, the scheme actuary must confirm that the Fast Track TPs test has been calculated and the results meet Fast Track parameters. They should also confirm that the Fast Track conditions for the recovery plan, the schedule of contributions and the low dependency liabilities are met.

The scheme actuary is being asked to confirm that the tests and conditions described in this document are met. These are factual matters and the actuary is not being asked to confirm as to whether, in their opinion, Fast Track is appropriate or the legislation and principles in the code are being complied with.

The scheme actuary should judge how much detail must be used in applying the tests or conditions. For example, simplifications can be made in the test calculations where the scheme actuary would be certain those simplifications would not influence whether the scheme met Fast Track parameters.

We will set out more detail of the expectations for the scheme actuary separately in due course.

Appendix 2: Projection of duration

All schemes are required to calculate current duration, according to the principles of the final draft code, in particular using economic conditions as at 31 March 2023 at each valuation.

Projected durations should be determined using liability cash flows.

For smaller schemes with 200 or fewer members, the projected time to the relevant date can be calculated assuming a simple proxy as follows:

- the time to significant maturity increases by four years for each year of duration where duration is less than 13 years

- the time to significant maturity increases by three years for the year of duration where duration is 13 to 16 years

- the time to significant maturity increases by two years for each year of duration where duration is 16 to 19 years inclusive

- the time to significant maturity increases by one year for each year of duration where duration is 19 years or more

This is set out in Table 6, showing the time to significant maturity (duration 10) from the scheme’s current duration.

For the purpose of determining the number of members in the scheme to see if the proxy can be used, the following members can be excluded:

- members who are eligible for lump sum death benefits only

- for hybrid schemes, members with DC benefits only

- fully insured annuitants where they are not included in the calculation of the TPs liabilities

Table 6: Proxy for projecting time to significant maturity

| Duration | Years until significant maturity reached |

|---|---|

| 25 | 33 |

| 24 | 32 |

| 23 | 31 |

| 22 | 30 |

| 21 | 29 |

| 20 | 28 |

| 19 | 27 |

| 18 | 25 |

| 17 | 23 |

| 16 | 21 |

| 15 | 18 |

| 14 | 15 |

| 13 | 12 |

| 12 | 8 |

| 11 | 4 |

| 10 | 0 |

This proxy is only suitable for schemes with 200 members or fewer who have not produced cash flows as part of their valuation.

The proxy is only suitable for those with a duration greater than 10. The table provides for the time to significant maturity based on the current duration of the scheme. The appropriate time for non-integer durations should be found by interpolation.

For schemes targeting a relevant date at an earlier duration, the table can be used to calculate the time to that duration. This should be calculated as the time taken from the current duration to duration 10 less the time from the targeted duration to duration 10 based on the values in the table above.

Appendix 3: Basis underlying the derivation of our Fast Track parameters

Financial conditions

We have calculated Fast Track parameters using financial conditions in force as at 31 March 2023.

In particular, we have adopted Bank of England gilt curves (both nominal and index-linked) when determining the Fast Track parameters.

Relevant date

As required by the regulations and as set out in the final draft code, duration is the definition for determining maturity, for both the relevant date and point of significant maturity.

We have set the relevant date for Fast Track as that consistent with when a scheme will reach duration 10. Duration 10 is the point of significant maturity as defined in the final draft code.

Therefore, in respect of the Fast Track parameters, we are adopting the relevant date as the point that the scheme reaches 10 duration years.

While we are aware that some schemes have an exemption from using duration 10 in the final draft code, for example cash balance schemes, for Fast Track purposes we are applying the relevant date as that consistent with duration 10 for all schemes.

Investment strategy underpinning our Fast Track approach

Fast Track does not define an actual investment strategy that trustees and employers should follow for Fast Track purposes. However, in order to determine the Fast Track parameters, we have needed to define an underlying investment strategy.

This investment strategy is the basis for determining the discount rate for setting the Fast Track TPs and has been used to calculate the investment and funding stress parameters.

Within our investment strategy, we have adopted the following approach.

- An initial growth allocation of 60% of the investment portfolio for schemes with a duration of 15 or over.

- A growth allocation of 15% in respect of the low dependency investment allocation (duration 10).

- For the matching portfolio, 35% of the allocation is in respect of corporate bonds.

- For the remainder of the matching portfolio, schemes hedge their inflation and interest rate risks assuming the following:

- Use index-link gilts first up to a maximum of either 100% inflation hedge or 2x leverage.

- Use nominal gilts as the balance on the hedging portfolio once the index link gilts achieve full inflation hedging, subject to an overall maximum on the overall gilt portfolio of 2x leverage.

- That hedging is achieved by matching the duration of the matching portfolio to that of the scheme’s liabilities, subject to the restrictions of maximum leverage.

- For these purposes, we use an assumed fixed duration on the bond portfolio of:

- 7.5 years for corporate bonds

- 21 years for index-linked gilts

- 17 years for nominal gilts

- Assume a linear de-risking approach over a period of 5 duration years.

- An assumption that 70% of the liabilities are inflation-linked.

- Cash is used as the balancing item and is negative in circumstances where leverage is assumed to be adopted.

Based on the above rules and a relevant date consistent with 10 duration years, this results in the following investment portfolio:

| Asset class | Immature (durations 15 or above) | Mature (durations 10 or below) |

|---|---|---|

| Growth | 60% | 15% |

| Corporate bonds | 14% | 30% |

| Index-linked gilts | 52% | 32.50% |

| Nominal gilts | 0% | 4.50% |

| Cash | -26% | 18% |

Discount rate

We have set the low dependency forward rate equivalent to Gilts + 0.5% pa.

At the immature end of the curve, TPs have been calculated using a forward rate of Gilts + 1.75% pa. We have adopted a linear approach to reducing the forward rate over the period of scheme duration 15 to 10.

Other assumptions

All other assumptions in line with the Fast Track low dependency assumptions. In particular, we have assumed mortality improvements using the core CMI 2022 Model with a long-term rate of improvement of 1.5%, assumed that 15% of the pension has been commuted at normal retirement age using a commutation factor of 18 and have adopted an expense reserve using the latest PPF parameters included in version A11 of their section 179 guidance.

The Fast Track stress parameters

The Fast Track parameters for determining the stress test adopt assumptions that are used by the PPF in their 2024/25 levy calculation.

For clarity, the factors and asset categories for Fast Track are our choice and may not be the same as the PPF’s in the future. Therefore, this test should always be based on the factors specified by us in this or superseding documents.

In applying the stress factors to the asset strategy, we have applied the following simplifications.

- Growth assets are assumed to be invested in line with overseas equities.

- The scheme’s benefits are assumed to have 70% inflation linkage with the remaining 30% to have nominal indexation.

- Where we have used leverage, the amount of leverage has been offset using negative cash.

Appendix 4: Summary of consultation responses

Question 1

We asked: Do you agree with how we have positioned Fast Track relative to the code of practice?

You said: There was strong support for how we have positioned Fast Track relative to the code, with some noting that key concerns with the first consultation had been addressed. In particular, respondents supported the separation of Fast Track from the code, with it no longer being a benchmark to assess Bespoke valuations but a regulatory filter for our assessment of valuations. There was no push back to Fast Track having greater flexibility than the code to be updated in the future, although some highlighted the importance of TPR setting a clear process. Suggestions were made to ensure important Fast Track messaging is explicit and clearly understood, including the role covenant plays.

Question 2

We asked: Are there any aspects of this you think it would be useful for us to clarify further?

You said: Some respondents used this to reiterate general feedback. Respondents requested that we provide explicit guidance and expectations, including when it is not appropriate to use Fast Track, when we will engage more closely with a Fast Track scheme (for example when the covenant is not appropriate), and how will TPR update Fast Track parameters in the future. A small number of respondents also requested more clarity on specific areas of technical detail.

Question 3

We asked: Do you agree that Fast Track should come with a lower level of burden in terms of the explanations required as part of the trustees' valuation submission?

You said: The significant majority agreed that Fast Track should come with a lower level of burden in terms of explanations required as part of the trustees’ valuation submission. However, any additional burden for schemes submitting a Bespoke valuation should be kept to a minimum, with the level of explanation and evidence determined by the complexity of the risk being taken to ensure the ask is not disproportionate to the regulatory need.

It was suggested that we provide a template or checklist for the statement of strategy, and consider a more tailored option for those schemes who meet all Fast Track parameters apart from the length of the recovery plan.

Question 4

We asked: Do you see any unintended consequences from requiring the scheme actuary to confirm when a submission meets the Fast Track parameters?

You said: While there was no significant challenge to our proposal for the scheme actuary to confirm a valuation submission meets the Fast Track parameters, clear conditions were suggested by respondents to limit unintended consequences. For example, Fast Track parameters should be clear with guidance provided to limit subjectivity, and it should be clear the actuary is only confirming whether the parameters have been met based on the assumptions used by trustees. Respondents wanted us to work closely with industry as it developed this confirmation approach.

Question 5

We asked: Could we make Fast Track more proportionate for schemes in differing circumstances?

You said: There were a mix of responses to this question, although many of these considerations have been picked up in the statement of strategy consultation. Responses to both consultations are being considered carefully as our approach to the statement of strategy is finalised. Those who did not think Fast Track needed to be more proportionate were largely concerned that this would increase burden, complexity and cost for following the Fast Track approach. Respondents did stress that while Fast Track should be less burdensome than Bespoke, Bespoke itself should not be overly burdensome, and the evidence requirements should be reasonable for all approaches.

Question 6

We asked: Are there other considerations not discussed in the consultation document we should be considering?

You said: The significant majority of respondents did not think there were further areas for us to consider. Of those that did raise further considerations, this was to reiterate comments also made in response to question 1-5.

Question 7

We asked: Do you believe it would be useful to include an additional set of parameters for schemes where the employer has a high insolvency risk?

You said: The significant majority did not think Fast Track should include an additional set of parameters for schemes where the employer has a high insolvency risk. Some respondents said we should set out clearly the circumstances in which it would not be appropriate to adopt the proposed Fast Track parameters, and that high insolvency risk is likely to be included. Three respondents thought tougher requirements could be introduced to set a higher bar, with some describing this as ‘two-track Fast Track’. However, others described this as unnecessary complication and reiterated that Bespoke needs to be seen as equal to Fast Track.

Question 8

We asked: Do you agree with our approach of setting the Fast Track technical provisions test as a percentage of the low dependency funding basis liabilities?

You said: There was overwhelming support for our approach for setting Fast Track TPs as a percentage of the low dependency funding basis liabilities. It was thought to be a sensible and pragmatic approach which was simple, easy to apply and communicate. The approach was also liked for the flexibility it gave to schemes to shape their journey plan and decide where to include prudence in the assumptions depending on their own circumstances. A small minority felt that the test was somewhat technical and complex. It was also raised that a scheme’s approach could involve iterative calculations to ensure compliance against Fast Track.

Question 9

We asked: Do you agree with the limits we have proposed?

You said: Due to the very technical nature of this question, relatively few respondents answered this question. Some respondents said they had no strong views and this was a decision for TPR. Almost all others agreed with the rationale for transitioning between Gilts +200bps at the immature end to Gilts +50bps at significant maturity. It was pointed out by some that the resulting limits, although reasonable at the March 2021 calculation date, would now be too strong in current market conditions if the point of significant maturity remained fixed at 12 years.

Question 10

We asked: Do you agree that for a Fast Track low dependency funding basis measure, the minimum strength of the discount rate basis should be gilts +0.5% with no inflation risk premium?

You said: There was general agreement from respondents to this question. A very small minority thought the approach was too weak, however more noted there was some risk of levelling down from more prudent basis to the Fast Track low dependency basis. A small number wanted Fast Track to have a dynamic discount rate option in addition to Bespoke.

Question 11

We asked: Do you agree that our approach to other assumptions in the Fast Track low dependency funding basis (as set out in Appendix 1) is reasonable?

You said: The significant majority of respondents agreed with our approach to the other assumptions in the Fast Track low dependency funding basis. However, respondents called for clarity on expectations on how to approach the expense reserve and commutation factors.

Some thought the wedge between RPI and CPI was too prudent, while others wanted the Fast Track assumptions to be assessed in aggregate rather than individually.

A very small minority appear to want more prescription or stricter requirements.

Question 12

We asked: Should we allow more flexibility for smaller schemes in relation to any of the assumptions?

You said: The majority of respondents agreed with our proposals. Two respondents suggested that the requirement for an expense reserve was disproportionate for small schemes and could lead to trapped surplus. Two respondents suggested the CPI proxy for small schemes was too prudent. Several respondents suggested extending the definition of small schemes.

Question 13

We asked: Do you agree that the maximum recovery length after significant maturity should be set to three years rather than six?

You said: The majority agreed with the proposal that the maximum recovery plan length after significant maturity be set to three years. With Bespoke being an equally valid option for trustees, respondents did not see complications with tapering and transitioning. Some respondents thought that three years did not fully factor in the time it takes to negotiate with the employer.

Question 14

We asked: Do you agree with our approach of using the valuation date as the starting point for the recovery plan length?

You said: Respondents acknowledged the merits of our proposal to use the effective valuation date as the starting point for the recovery plan length, saying this provides consistency across all schemes and removes incentive to delay completing the valuation. Some pointed out that it typically takes 12 months or more to complete the valuation, and considered whether this should be built into the recovery plan length.

Question 15

We asked: Do you agree with our approach to how to allow for post valuation experience in Fast Track recovery plans?

You said: Among those who responded, there was overwhelming support for our proposed approach, with a plea from some for further clarification on how the submission process will differ for those who choose to allow for post valuation experience.

Question 16

We asked: Do you agree that annual increases to deficit repair contributions should not be more than CPI?

You said: Respondents mainly agreed that CPI indexation provides sufficient flexibility in Fast Track and is a sensible way of avoiding excessive back-end loading, recognising that schemes have the bespoke option for more complex strategies. Some suggestions were proposed to deal with irregular front-loaded DRCs and DRCs that increase at fixed rates.

Question 17

We asked: Do you agree with our approach for the stress test?

You said: The majority agreed and were comfortable with the proposed approach to the stress test. However, some issues with the simple approach proposed were raised, including that, the test can be gamed. When raising issues, some noted that addressing some of the issues raised would reduce the simplicity of the test and would need to be considered in that context.

Question 18

We asked: Do you agree with the limits we have proposed?

You said: A significant majority agreed with our approach. Although generally positive there was some concern that the test on low dependency investment allocation was too strong when compared to the code principles, although there was acknowledgement that those who wanted to take more risk with their investment strategy after the relevant date could submit their valuation through the Bespoke route.

Question 19

We asked: Do you agree with how we have allowed for schemes in surplus within the stress test?

You said: All respondents agreed with the proposed allowance for surplus within the stress test. However, several respondents were concerned that surplus which may be intended to be used to pay future expenses or future accrual could be double counted.

Question 20

We asked: Do you agree it is reasonable to use the Pension Protection Fund (PPF) Tier 1 asset classes?

You said: While a significant majority agreed with the proposal, some respondents disagreed. Issues captured in earlier questions were reiterated, for example concerns the test does not allow for the duration of asset holdings. Some pushed for the Tier 2 information used by the PPF to be incorporated into Fast Track stress tests.

Question 21

We asked: Do you agree that smaller schemes should not have to produce cash flows to calculate projected duration?

You said: The overwhelming majority of respondents agreed with our approach and very few issues were raised. Some of the respondents agreed on the basis that there should still be an option for schemes to produce cashflows.

Question 22

We asked: Do you agree with the proxy we have proposed for smaller schemes?

You said: The overwhelming majority of respondents agreed with the proxy we proposed. There were very few comments in relation to this question.

Question 23

We asked: Do you agree with our definition of smaller schemes for this purpose?

You said: A significant majority of respondents agreed with our proposal, but several wanted a wider definition encompassing more schemes. Of those who did not agree, most wanted to extend the definition, either by increasing the number of members or by using a definition based on assets or liabilities, or a mixture of membership and assets/liabilities. However, several respondents appreciated the current proposals aligned with current legislation. Clarification was sought on whether the definition of membership excluded DC only schemes for hybrid schemes. A small number of respondents wanted to exclude insured members.

Question 24

We asked: Do you agree that six years is a reasonable Fast Track parameter for the allowance of extra accrual in open schemes?

You said: A significant majority of respondents agreed that six years is reasonable as an allowance for future accrual. Those that agreed did so for a variety of reasons, with some agreeing that Fast Track was a regulatory tool and therefore it was up to us to set the parameters it felt appropriate. A small minority thought six years may be too short.

Question 25

We asked: Do you agree with our approach for new entrants?

You said: The proposed approach was supported by the overwhelming majority of respondents. As noted above, the majority were positive and some noted that Bespoke submission remained an option for those not meeting Fast Track parameters.

Question 26

We asked: Do you think having no additional restrictions on future service cost will weaken the Fast Track approach significantly?

The overwhelming majority of respondents were content with our approach. There was near unanimity in agreement to this question with only two arguing that not having additional restrictions weakened the Fast Track approach significantly. Many respondents noted the schedule of contributions provisions as giving enough comfort on the strength of the approach.

Question 27

We asked: Which of the options for reviewing our parameters do you prefer?

You said: There was a split between the two options, although the majority of respondents preferred option 2 – more regular reviews of the Fast Track parameters. Many were happy with an annual review aligned to the annual funding statement, with a more detailed review every three years. It was thought this would result in smaller changes and avoid a larger step-change, also giving trustees a better view of general changes in direction. However, whether respondents favoured option 1 or 2, they wanted as much stability as possible – there were different ways suggested of how this could be achieved. The priority for nearly all respondents was for us to ensure any changes were announced early to avoid disruption to valuations in progress. It was suggested changes could be announced in the April annual funding statement for the next valuation cycle.

Question 28

We asked: Do you think a different approach to reviewing our parameters is preferred?

You said: There were limited responses to this question. No alternative suggestions for reviewing the parameters were suggested. Some respondents reiterated responses to previous questions.

Question 29

We asked: What further analysis do you think would be helpful to illustrate the potential impacts of any final regulations and code?

You said: Of those who responded to this question, suggestions included updating the analysis to reflect recent market conditions, showing separately the impacts for:

- schemes expected to level down

- others who may have to increase their TPs and contributions and

- stressed schemes that may not be able to increase TPs and contributions

Any comments not captured in other questions

You said: No further comments were raised that were not picked up elsewhere in the response.

Appendix 5: Behaviour analysis assessment

Introduction and key results

We have commissioned modelling from our internal actuarial team to illustrate the expected number of schemes whose existing funding and investment strategy would satisfy the Fast Track parameters, and the impact of potential behaviour changes on the DB universe.

In doing so, we made assumptions around whether trustees adjust their valuation approach in the context of the regulations, the final draft code and Fast Track.

This is a summary of the analysis to put Fast Track in context and is not a formal impact assessment.

Our modelling illustrates two main areas.

- The number of schemes expected to meet the Fast Track parameters with no change to their funding and investment approach on ‘Day 1’ of the new regime.

- The potential aggregate impact on technical provisions (TPs) and deficit repair contributions (DRCs) based on a set of assumed behaviours by trustees and employers.

We have provided further scenarios to show the sensitivity to changing assumptions on behaviours.

Our analysis has been carried out as at 31 March 2023. If this analysis was carried out at a different date, the results may vary.

We estimate that as at March 2023:

- 62% of schemes meet all Fast Track parameters

- a further 19% could change their funding approach at no extra cost (and without needing to change their investment allocation) and meet all Fast Track parameters

- 99% of schemes meet the Fast Track parameters in at least one of the three areas

The analysis shows that there is not a material change at the aggregate level to funding positions or DRCs when allowing for the regulations, final draft code and Fast Track. This is based upon the assumption that some trustees will 'level up' and some will 'level down', depending on their current funding strategy and funding position.

For schemes we have modelled as increasing DRCs, we estimate that an additional £0.4 billion of DRCs will be required on day 1. For schemes reducing DRCs, we estimate that £0.5 billion lower DRCs will be required on day 1.

The results of this sort of analysis will be very sensitive to the assumptions made, and the analysis will be heavily weighted and influenced by a small number of large schemes. In practice, we expect many of these larger schemes will put in place bespoke funding solutions that take account of their scheme and employer-specific circumstances.

This updates the analysis we published as part of our December 2022 consultation. It allows for:

- updated DB scheme valuation and recovery plan data

- updated calculation date and market conditions as at 31 March 2023

- final Fast Track parameters, including making allowance for an expense reserve in Fast Track liabilities

Aside from these allowances, it uses a consistent approach to the December 2022 consultation analysis.

The most significant factor affecting the results compared to our previous analysis is the changed market conditions. This means that, compared with the previous analysis, aggregate funding levels are higher, aggregate DRCs are lower, and a higher proportion of schemes are estimated to meet the Fast Track parameters.

Full details of the method, assumptions and limitations are set out in the data, methodology, limitations and behavioural assumptions section.

Methodology

The model is not intended to draw conclusions for individual schemes, given the broad assumptions on how trustees will behave. It aims to provide an illustration of the potential broad aggregate impacts at the universe level. The modelling estimates TPs and DRCs on three different bases: 'Counterfactual', 'Fast Track' and 'Central Estimate'. These are outlined below and described in more detail in the data, methodology, limitations and behavioural assumptions section.

- Counterfactual represents our estimate of the funding approach each scheme would have adopted in the absence of a new regime.

- Fast Track represents the theoretical position if each scheme adopted a funding approach exactly aligned with the Fast Track parameters. This is provided for context – we do not consider this an expected outcome.

- Central Estimate represents an illustration of schemes’ funding approaches if the regulations, the final draft code and Fast Track had been in force at the calculation date. It assumes behavioural changes where some trustees adopt more or less prudent TPs assumptions (“levelling up/levelling down”), and longer or shorter recovery plans, compared with the Fast Track parameters.

Our levelling up assumption is based upon the view that, for some trustees, it may be appropriate for them to strengthen their TPs and/or increase DRCs to meet the new requirements.